Closing Comments

Craig Haugaard

May 13, 2015

We had a very light news day in the grain markets today. The USA dollar was sharply lower which helped offer support to grains. The weather is still very good with an active pattern will produce above average precipitation in the Corn Belt during the next 7 days. The 6-10 forecast calls for below average temperatures in the western Corn Belt, and above average temperatures in the eastern Corn Belt. The past couple of days we have seen an increase in articles talking about the developing El Nino weather pattern. It kind of feels like we may add back some risk premium with much of the growing season yet to come. Translating that last sentence to English, it feels like it may work higher in the near term.

Corn:

The weekly ethanol report showed 95.76 million bushels being ground up to make ethanol last week. That was a couple million more bushels than last week but still leaves us needing to average 101.331 million bushels per week to achieve the USDA projection.

With the futures prices trading near contract lows we are seeing producers across the Corn Belt hanging tightly onto their corn and as a result we are seeing firm basis levels across the Corn Belt. That tight farmer holding coupled with a weaker dollar allowed us to post a higher close for the second day in a row.

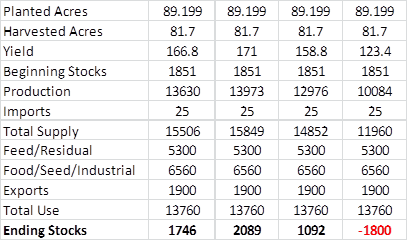

In my opening comments I mentioned that potential for adverse weather to take this market higher. The following table looks at the numbers the USDA gave us yesterday in the first column and then plugs in the national average yield for the previous three years while leaving all the other numbers unchanged to give you an idea of what kind of scenario would be required to goose this market.

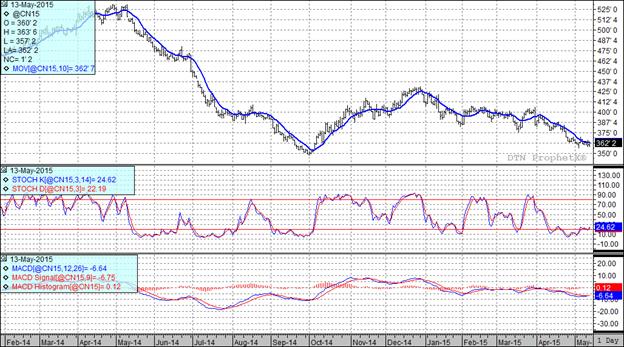

At the present time two of my three technical indicators are bullish the July futures and bearish the December corn futures.

Soybean:

Limited news in the soybean world today. We continue to hear reports of sporadic strikes in Argentina but they really haven’t amounted to anything.

We did have additional bad news for soybean meal today with the first case of bird flu in a broiler operation showing up in Iowa. Yesterday Nebraska logged their first case. So far 32 million birds have had to be destroyed as a result of the bird flu.

On Friday we will get the April NOPA crush numbers. The average guess is looking for a crush of 148.211 million bushels. This compares to 162.82 million bushels in March and 132.67 million bushels last year.

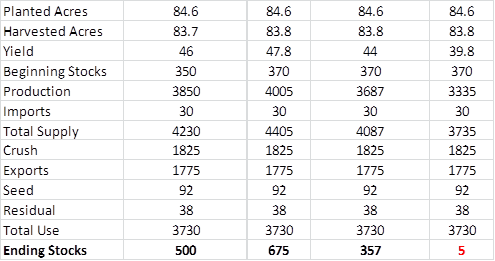

I played the same game with beans that I did above with corn and arrived at the following table. As you can see, the odds of a major bean rally are not very good at all.

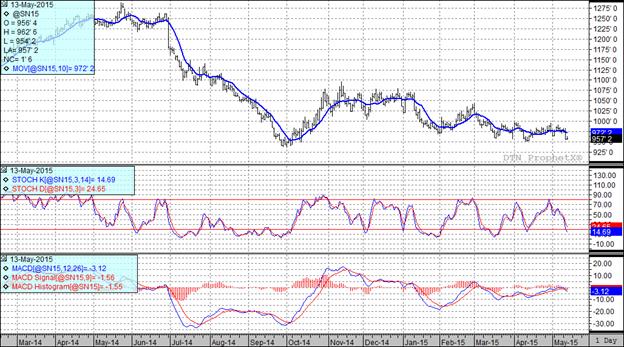

At the present time all three of my technical indicators are bearish both the July and November soybean futures.

Wheat:

What little news I heard today all seemed to be focused internationally. The talk of an El Nino weather pattern has the bulls a little excited since that is usually associated with the type of weather that hurts the wheat crop in Australia. We will have to be patient and see if that develops or not.

The other story is one that has been out there for some time but we are now approaching the moment of truth with it. As we have been reporting in this space the speculation has been that on May 15 Russia was going to remove or reduce their tax on wheat exports. We are darn near to May 15th so will know definitively on Friday how much truth there has been to this story.

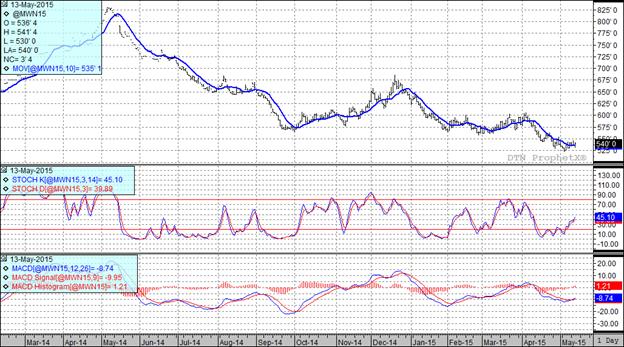

All three of my technical indicators remain bullish both the Minneapolis and Kansas City July futures.

Top Trending Reads: