Craig's Closing Comments

Craig Haugaard

July 24th 2015

It is national hotdog day today.

A number of folks have been complaining a little bit because I haven’t talked about my slow cousin Jimmy lately. I even had a guy today ask me if Jimmy had passed away. Fortunately Jimmy is alive and well. In fact I ran into him at a family 4th of July get together. He had already had a couple of adult beverages when he came up to me and kicked off the following conversation,” Cwaig, I’ve been thinking. A hewd of buffalo can only move as fast as the slowest buffalo. When the hewd is hunted, it’s the slowest and weakest ones at the back that are killed fiwst. This is good for the herd because the speed and health of the whole hewd keeps impwoving by the killing of the weakest membews. Cwaig, my bwain is the same way. It can only think as fast as the slowest bwain cells. They tell me that dwinking alcohol kills bwain cells. If that is twue it must attack the slowest and weakest bwain cells fiwst. So, the mowe beew I dwink the mowe I kill the weakew bwain cells, which makes my bwain fastew and mowe efficient. That’s why I always feel smawtew when I have been dwinking.” It is hard to argue with “Jimmy logic.”

Corn:

We had the usual pressure from talk of good weather today but in a new twist we seemed to get some pressure as concern over the Chinese economy impacted commodities. Last month the Chinese stock market experienced a drop of over 30%. This drop in turn seems to have caused institutional money to pull out of that market. This in turn impacted Chinese companies who were using excess capital that was being provided by investors who were chasing the commodity bull and the Chinese growth story. Many Chinese companies were using this excess capital to stockpile crude oil, base metals, and ag inventories and with that money now seemingly drying up so too is the bullish demand that was generated by that stockpiling.

There was other corn related news coming out of China today, and it too was bearish in nature. China recently had an auction of their reserve corn in which they offered 5.3 MMT for sale but could only get 126,000 tons sold.

I did hear some export talk today. Unfortunately it was talk that Brazilian corn is now being sold into the eastern coast of the USA. It appears that the earliest cargo could arrive within 30 to 45 days. Yesterday in this space we discussed the impact that the weak Brazilian real/ strong USA dollar was having and that is certainly a driving force in making this type of trade work. I am also hearing that Brazilian corn is starting to work into Europe as well.

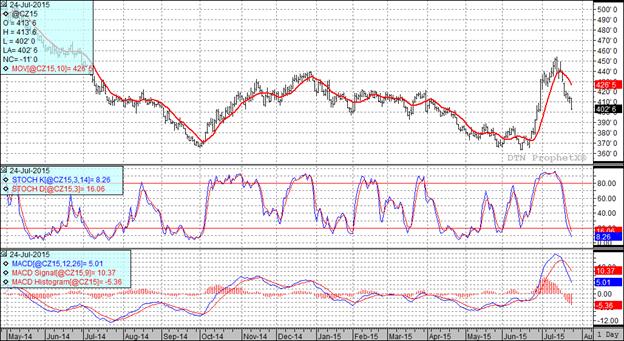

As far as weather goes, I am hearing some talk that this year is shaping up much like 1993. I think there are some significant differences between the two years but so far it is interesting to see how the two years are matching up. The following chart was 1993 in black while the red chart is the current December 2015 futures.

At the present time all three of my technical indicators are bearish both the September and December corn futures. It looks like we will soon see if the support at $3.97 ¾ stops this freefall. Funds were sellers of 16,000 contracts during the session today.

Soybean:

At the risk of sounding somewhat like a broken record, the trade continues to focus on good weather, a large South American crop and lagging Chinese demand.

Speaking of South America, a new report from Abiove says that Brazil will export 50.3 MMT of soybeans this year. This is up from the 48.7 MMT estimate that they put out in June. The USDA is currently projecting Brazilian exports to come in at 46.8 MMT.

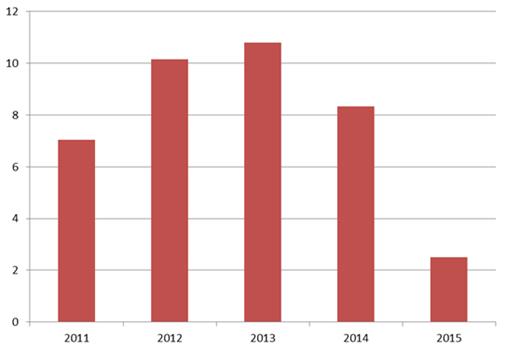

Finally, I have been mentioning that the Chinese new crop soybean purchases have really been lagging what we have seen in recent years. To help you visualize this a little better the following chart shows the export sales in MMT that had been made each of the past five years as of July 16th. It would appear that the lagging Chinese economy coupled with a strong South American export program is dramatically impacting our new crop exports. We still have time to catch up but so far these are very sobering numbers.

Chinese New Crop Soybean Purchases

(MMT)

All three of my technical indicators are currently bearish for both the September and November soybean futures. Funds were sellers of roughly 8,000 soybean contracts today.

Wheat:

We saw wheat prices trade lower again today as they continue to search for a price level at which they can generate some demand. Right now it seems like the USA wheat market is heading lower in an attempt to find export interest and to price itself into the feed market. I don’t know where that price level is but apparently we have not found it yet.

Our neighbors to the north had the CWB Canadian wheat tour of western Canada going on this week. The numbers that I have seen them come out with indicate that the spring wheat yield will come in at 38.9 bu/acre. This is down from 45.7 bu/acre last year.

In spite of the sharp decrease in production from last year tour participants said that conditions were not as bad as they had expected. In fact the CWB raised its western Canadian production estimate of all wheat to 23.1 MMT from 22.02 MMT.

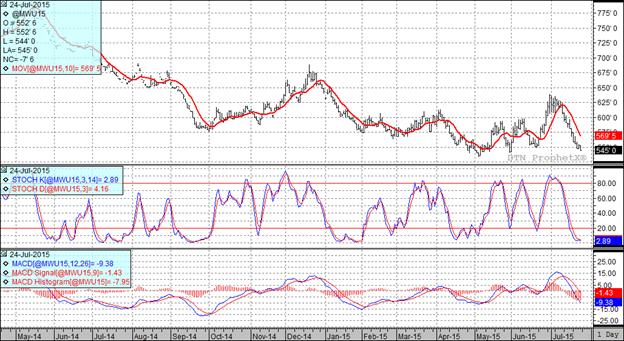

At the present time all three of my technical indicators are bearish both the Minneapolis and Kansas City September futures.

This data and these comments are provided for information purposes only and are not intended to be used for specific trading strategies. Commodity trading is risky and North Central Farmers Elevator and their affiliates assume no liability for the use of any information contained herein. Although all information is believed to be reliable, we cannot guarantee its accuracy and completeness. Past financial results are not necessarily indicative of future performance. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples.

Top Trending Reads:

Topics: Grain Markets