Craig's Closing Comments

Craig Haugaard

August 18, 2015

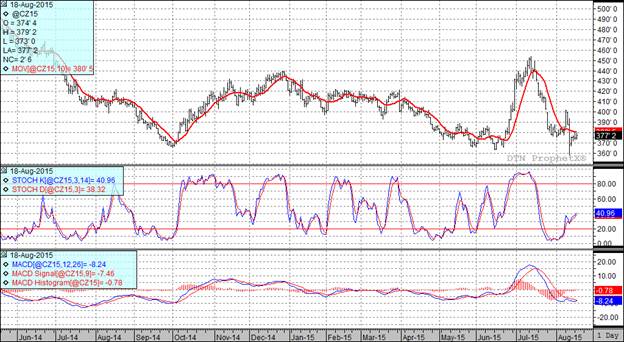

Corn:

The Pro Farmer crop tour continued across the fruited plain today and found, as expected, a very good crop in the western Corn Belt. On the other hand the tour participants reported a great deal of variability in the eastern Corn Belt. One thing that I saw reported by several sources is that the ear count is good but when you husk it you find a very short ear. I know the USDA uses ear counts as part of the formula they use to determine projected yield. Could this short ear phenomenon be the surprise that catches traders off guard and ultimately give the bulls some fuel to run on?

Speaking of the USDA numbers, I was visiting with an analyst today when he made the comment that the projected yield this year didn’t match up with the bushels of yield per point of crop rated good to excellent last year. I don’t believe that I have ever seen it compared this way before but it is an interesting concept. Last year we had a final crop rating of 72% good to excellent with a national average yield of 171 bu/acre. That would give us 2.375/bu per point of good to excellent. If we took that 2.375 and multiplied that times yesterday’s good to excellent rating of 69% we would get a projected national average yield of 163.9 bu/acre which is 4.9 bu/acre less than the USDA gave us to contemplate in last week’s report. I don’t know if there is any validity in looking at it this way but I found it interesting if nothing else.

At the present time two of my three technical indicators are bearish both the September and December corn futures.

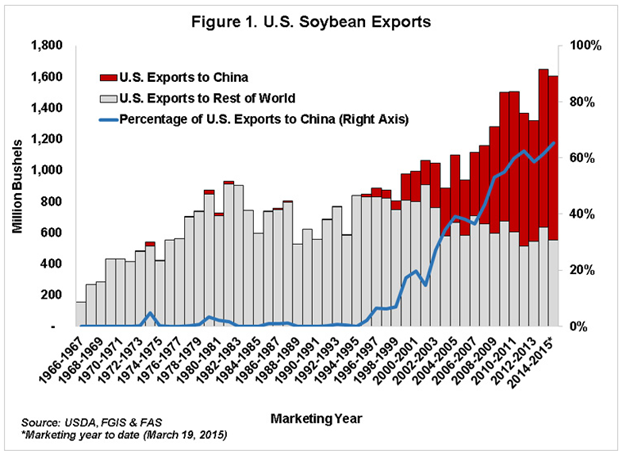

Soybean:

The Chinese stock market was on the ropes and being pummeled and the fear that the Chinese economy could be in trouble weighed on the soybean market during today’s session. The following chart helps to illustrate the importance of the China to our export market.

On the weather front most of the Midwest is expected to see beneficial rains during the next few days. That coupled with a crop conditions/progress report on Monday that showed a crop with unchanged ratings and progress that were right in line with the five year average had the4 bears in charge of the market.

At the present time all three of my technical indicators are bearish both the September and November futures. The funds continued to add to their short position today.

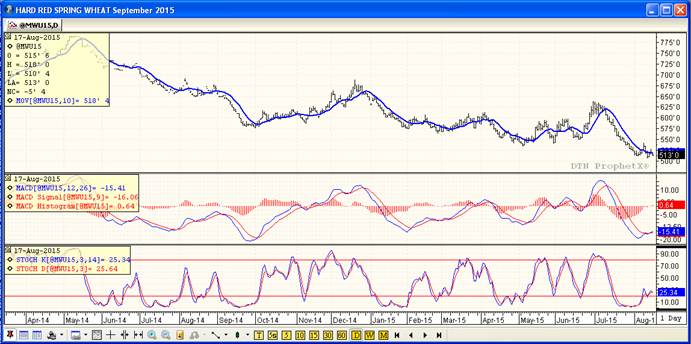

Wheat:

The wheat market is experiencing a bearish combination of weak demand, large yields and better than anticipated spring wheat conditions. This deadly combination had wheat prices on the defensive once again today.

On the demand side of the equation we find that export business for USA wheat remains slow while world stocks continue to increase.

Here in spring wheat country spring wheat harvest was reported at 53% in yesterday’s report. Harvest continues to make good progress with many producers here in South Dakota wrapping up.

The funds are short and adding to their short position. All in all we just do not have a compelling story to tell in wheat right now.

With today’s close all three of my technical indicators are bearish both the Minneapolis and the Kansas City September futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%