Craig's Closing Comments

Craig Haugaard

August 19, 2015

Corn:

The Pro Farmer crop tour rolled on today with reports coming from Nebraska and Indiana. Tour participants pegged the Indiana yield at 142.9 bu/acre versus the USDA’s August estimate of 158 bu/acre. They came up with an average of 165.2 bu/acre for Nebraska. The USDA has Nebraska pegged at 187 bu/acre. Historically the Pro Farmer tour has been fairly low on the Nebraska yields. If history is any guide today’s results probably mean we should see Nebraska at about 181 bu/acre.

In domestic demand news the weekly ethanol report showed 101.325 million bushels used in the production of ethanol last week. We are left needing to average 97.959 million bushels per week to achieve the USDA projection.

In news out of China the government said it will continue stockpiling corn for another year. Many in the market had feared the government was going to release it back onto the world market so we appear to have dodged that bullet.

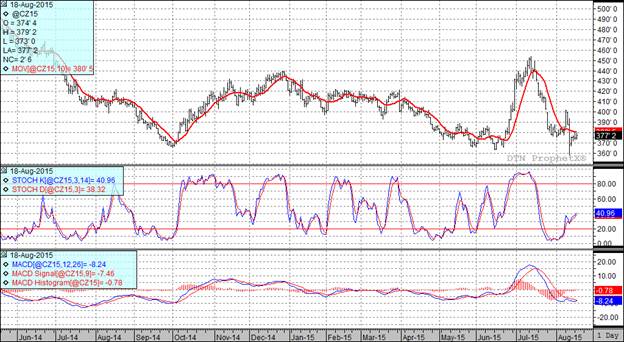

At the present time two of my three technical indicators are bearish both the September and December corn futures.

Soybean:

The Pro Farmer tour is reporting variable soybean conditions with a range of pod counts. One report that jumped out at me was in Illinois where they came up with an average pod count of around 1450 versus last year’s 1242. We will get the day’s official results out at around 7 p.m. tonight so should have more to talk about tomorrow.

I believe that the biggest market movers today were the good weather forecast and additional bearish news regarding China’s currency. That pressed the market lower and once we broke below the $9.00 level in the November futures we saw sell stops triggered which pushed us still lower.

At the present time all three of my technical indicators are bearish both the September and November futures. The funds were sellers of roughly 9,000 contracts today and are now believed to have a position of long 11,000 contracts.

Wheat:

We seem to be drowning in wheat and world wheat production seems to be getting larger.

In Australia the extended forecast is now calling for conditions in the next 10 to 14 days. I see that private analysts in that nation have raised their estimates of that crop by 1 MMT with most experts now looking for a crop in the 26 to 27 MMT range.

In Europe have had Russia hosting a Kmart blue light special as they have been the sellers of the lowest priced high protein wheat in the world. Now, however, it appears they have some competition with some French wheat that is currently being offered at a lower price than the Black Sea wheat and yet still has not found a buyer.

I think the only good thing that happened today was that the funds were not sellers of wheat today and that, coupled with a little better corn market allowed us to get through the session without too much damage.

Two of my three technical indicators are bearish both the Minneapolis and the Kansas City September futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%