Craig’s Closing Comments

Craig Haugaard

August 24, 2015

The headlines are certainly exciting these days. In case you missed it here are a few that jumped out at me today.

Angry investors capture head of China metals exchange – Financial Times of London

Households just saw $1.8 trillion in wealth vanish as stocks fall – Market Watch

Stock up on canned food for stock market crash, warns former Gordon Brown adviser – The UK Independent

Corn:

We kicked the day off with a real Chicken Little; the sky is falling kind of reaction. The stock market was in free-fall with the DOW futures down over 1,000 points and traders were rushing to sell everything. This pressed the corn futures down in excess of a dime but then traders seemed to take a deep breath and started trading the fundamentals.

The fundamentals that came into play today and allowed the corn futures to post a higher close were the weakness of the dollar and the perception, on the heels of the Pro Farmer report, that the yield prospects are not a rosy as the picture laid out in the last USDA report.

Let’s start with the dollar. So far this year we have been getting kicked in the export market. As I look at new crop exports I see that so far we have only sold 12% of what the USDA is projecting we will sell for the new crop year. The five year average for this point in time is to be at 25% sold so we are clearly lagging where we should be and in fact are running down 38.9% from last year. Obviously none of that sounds good but one of the main culprits has been a strong dollar. Today the dollar was plummeting and that made traders cautiously bullish on corn. The following weekly continuation chart shows the spot dollar futures (black line) and the spot corn futures (red line). If history holds a falling dollar should raise corn prices.

Speaking of exports we had the weekly export inspections number out today. For corn we had 34.8 million bushels of inspections and, with one week remaining in the export year will need to have 128.8 million bushels of export inspections next week to hit the USDA’s projection for the year. That is not going to happen.

The other supportive factor today was the results of the Pro Farmer crop tour. As traders contemplate the fact that the national average yield may be in the 164 range rather than the 168.8 bu/acre presented to us in the August USDA report it becomes much harder for them to sell the market at this level.

After the close the weekly crop ratings came out and, as expected, showed the crop unchanged at 69% good to excellent. Last year at this point we were 73% good to excellent while the five year average is 55.6% good to excellent.

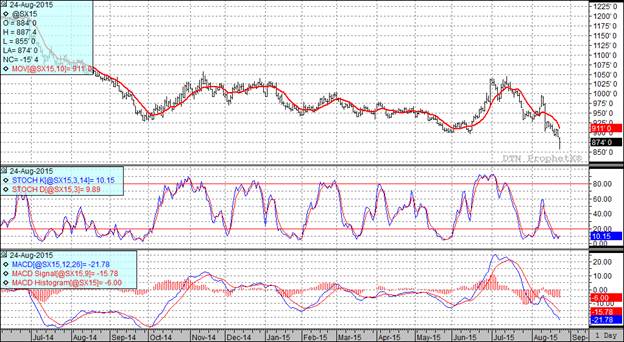

At the present time all three of my technical indicators are bullish both the September and December corn futures.

Soybean:

With the Chinese stock market leading this little parade into the gutter we never saw beans trade on the plus side today. By now we are all well aware of how important China is to the bean market and with their economy doing a swan dive nervous traders pressed beans lower. As if that wasn’t bad enough today also saw the Brazilian Real fall even faster than the dollar was falling so at the end of the day we are less competitive with Brazilian soybeans than we were when the day began.

Weekly export inspections came in at 7.7 million bushels so with one week remaining in the marketing year we need to have inspections of 2.3 million bushels to achieve the USDA’s projection. I think we will end up a bit stronger than that.

At the end of the day China seems to be the key to this market and that should cause all of us to toss and turn at night.

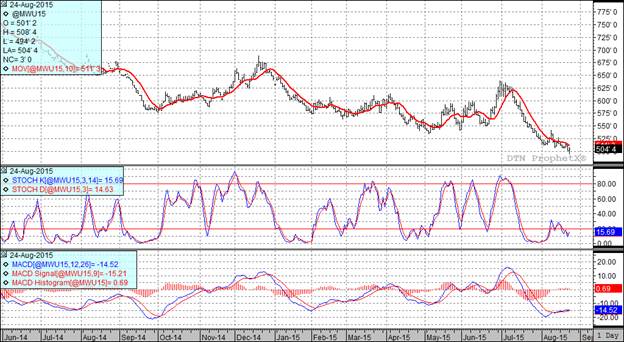

At the present time two of my three technical indicators are bearish both the September and November futures.

Wheat:

Not a lot of positive news for wheat but it was pulled higher as corn rebounded today.

Weekly export inspections were a touch disappointing, coming in at 10.2 million bushels. We have 40 weeks left in the marketing year we will need to average 19.1 million bushels per week to hit the USDA’s mark.

On the international front I see that the Russian Ruble was weaker against the dollar so they will continue to have an edge in the export market. In Australia the conventional wisdom is that El Nino brings dry conditions but they continue to defy that this year as they once again got good rains and have good moisture levels in the wheat growing section of that country.

Two of my three technical indicators are bullish both the Minneapolis and the Kansas City September futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%