Closing Comments

Lynn Miller

August 25th, 2015

China continues to be the market mover of the day. Giving us a corrective tone to start the morning as they announced they would implement further measures to stem the selloff. They announced cutting key lending rates by 25 points and moreover would lower the banking reserve rations by 5 basis points. This news did rally broad markets and supported US indices, most notably a 1.25% raise in the dollar.

Corn:

We closed lower today in a choppy low volume day. I guess if you’re looking for something positive, the Dec contract has been holding between $3.70 and $3.90 during some real volatile times. Many analysts believe that prices below $3.70 will force bushels to the bin. Talk a dry August may be reducing yield is floating around, also talk of yields in Iowa shrinking now due to disease pressure.

Technically all three indicators are bullish the December futures. Mind you; however, that we closed right on the moving average today and the stochastics are in neutral territory, so we could be easily persuaded to make a technical move either direction from here. Look for support at $3.57 with selling targets at $3.80, $3.94 and $4.05.

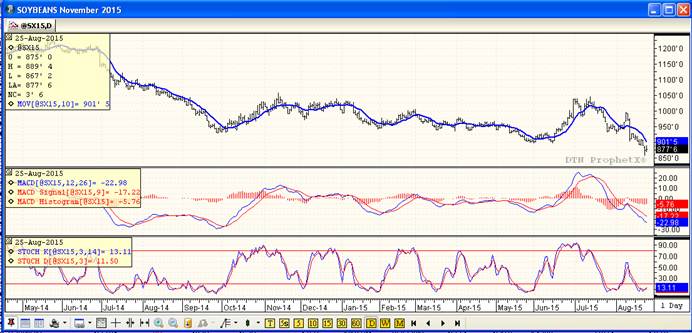

Soybeans:

Well, they hung on for a higher close even though well off of session highs. Many fear with a slower export pace than this time last year we may have a tough time getting above $8.90 till harvest pressure starts to ease. Right now the market is trying to price beans into the export market while fighting a strong dollar, an eager SA seller and tight US holding. At the same time, the forward curve in beans is a jumbled up mess of carries and inverses that shows an unfilled nearby pipeline and an expect glut 1 year out.

Technically two of three indicators continue to be bearish the November futures. The stochastics; however, have issued a buy signal in oversold territory. Look for support @ $8.56 with selling targets at $9.00, $9.28 and $9.50.

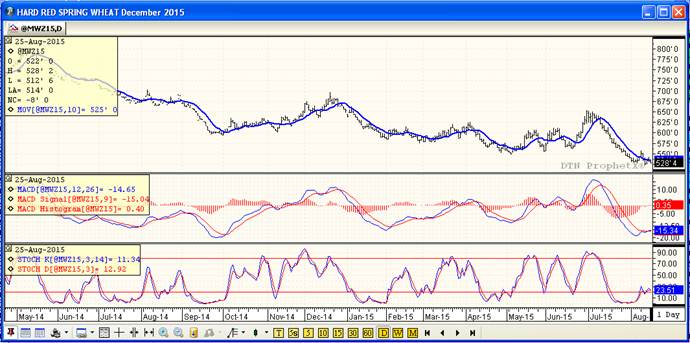

Wheat:

Overnight support could not be maintained into the day session were weakness in corn and a higher dollar are both negatives. Today’s close was a negative, but so far (knocking on wood) the recent lows have held. But, overall, we are still not competitive in the world export game and a large crop coming at the market is not helping our cause.

Technically, 2 of 3 indicators are currently bearish the Minneapolis December futures. The Moving average appears to be hanging right on the edge just barely above the day’s trade action and the stochasitcs are showing neutral in oversold territory. Here’s hoping $5.12 will hold as support. Look for sale targets at $5.45, $5.65 and $5.80.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%