Closing Comments

Lynn Miller

August 26th, 2015

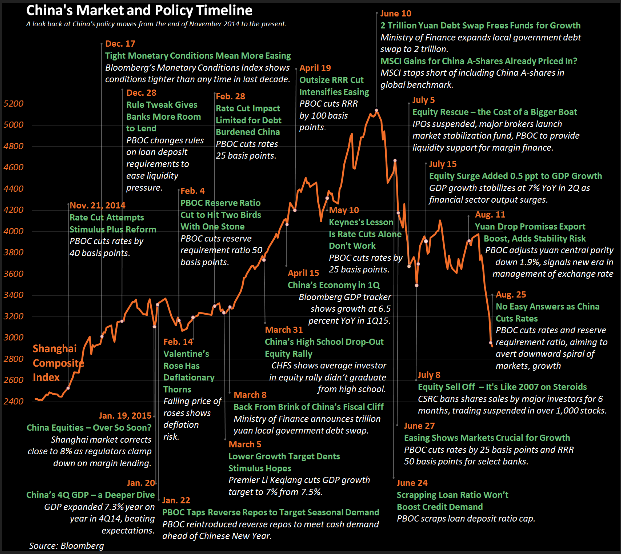

I read an article in Bloomberg today that outlined China’s actions for the past year, the rally and the recent sharp selloff. These actions have cost world equities a total somewhere in the realm of $5 trillion dollars. China is looking for scapegoats while the rest of the world is just simply blaming China in one way or the other. It’s an interesting little read about how this has built over time.

Corn:

About the only news the market got today was the weekly ethanol numbers. And they weren’t real supportive with production once again down at 952 Bbl/day, as has been the trend since the end of May.

Estimates for tomorrows export sales report are 50K-250K old crop, 450K-650K new crop.

What a difference a day makes. Technically , two of three indicators are now bearish the December futures. Once again today we made a move right to resistance of $3.80 and backed off – that’s not good news in bull camp. Look for support at $3.57 with selling targets at $3.80, $3.94 and $4.05.

Soybeans:

Yesterday’s poor settlement and lack of follow through coupled with zero export sales reported today leaves beans closing at new contract lows. Export sales tomorrow not expect to offer any game changing insight with old crop sales expected to be net negative and new crop sales below 1.0 MMT.

Technically, we have seen no change in the outlook in the past 24 hours. Currently all three indicators remain bearish the November futures. The stochastics; however, remain in oversold territory. Look for support @ $8.56 with selling targets at $9.00, $9.28 and $9.50.

Wheat:

News in wheat was pretty slim today also. One thing did interest me though, Black Sea offers (you know the blue light specials) could not even find homes today. Iran said they have no need for Wheat until next March. Yields and quality appear to be good nearly everywhere, Canada included.

Minneapolis spot values were unchanged for high pro wheat while low pros were firm to better.

Exports tomorrow expected to be 300k-450k.

After today’s price action all three indicators are now bearish the Minneapolis December futures. Here’s hoping $5.12 will hold as support, if we aren’t already using up what luck we have. Look for sale targets at $5.45, $5.65 and $5.80.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%