Craig’s Closing Comments

August 27, 2015

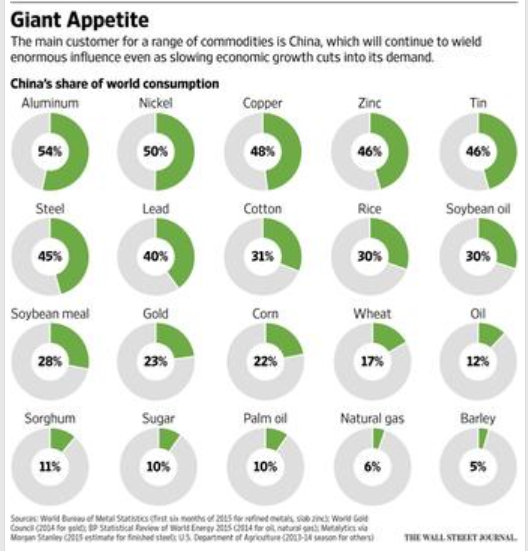

We have had a great deal of talk about China the past week. I know folks are getting sick of hearing about it but at the risk of beating a dead horse the following chart really illustrates the role that China plays as the Big Dog in the commodity market. If their economy falters demand for a lot of commodities could plummet.

Corn:

We kicked off the morning with the weekly export sales report and then really had very little to trade on for the remainder of the session. Weekly corn exports are disappointing for the current crop year, coming in at a net cancellation of 5.2 million bushels. The 2015-16 export sales, on the other hand, exceeded the top end of trade estimates at 38.8 million bushels. While it was encouraging to see the good new crop number it is still important to keep in mind that we are still running at the slowest new crop sales pace in the past five years.

The other factor that seemed to come into play today was a stronger dollar which once again weighed on prices.

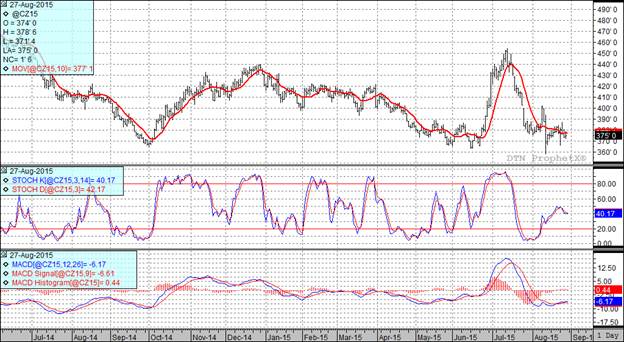

At the present time two of my three technical indicators are bearish both the September and December corn futures.

Soybean:

Perhaps the biggest factor in the bean market today was the fact that the Chinese stock market was higher. This led to increased optimism over the Chinese situation and in turn had traders hopeful that we will see increased demand.

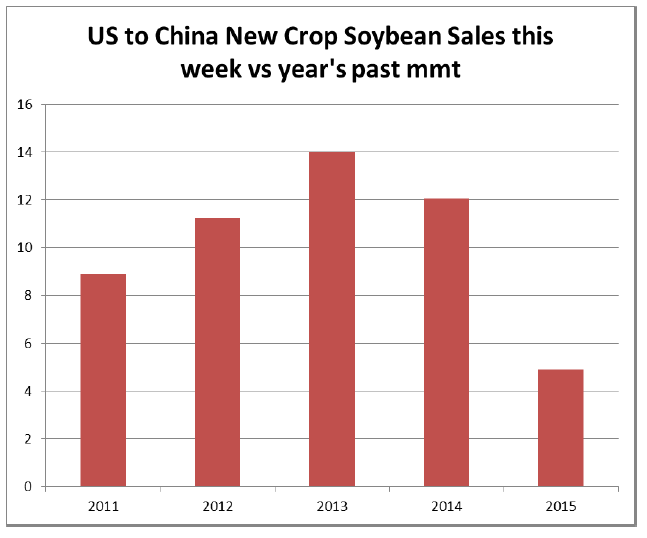

The weekly export sales showed net cancellation of old crop sales to the tune of 4.84 million bushels while new crop sales were a very good 536.6 million bushels. As you can see on the following graphic, we continue to lag far behind the normal sales pace to China so hopefully we will kick that into high gear in the near future. If China continues to head to South America for their needs our price picture could get even more dismal.

At the present time two of my three technical indicators are bearish both the September and November futures.

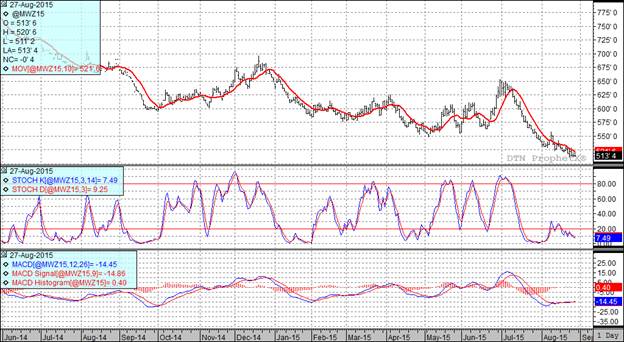

Wheat:

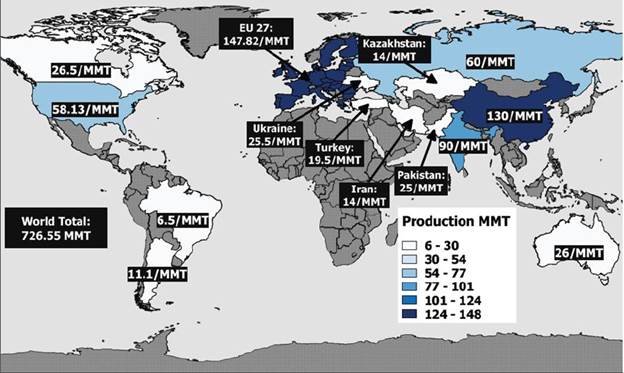

We all know that wheat truly is a world crop but it is interesting to look at the USDA’s projection for 2015-16 world wheat production to get a sense of the magnitude of world wheat production.

Here in our part of the world spring wheat harvest is getting close to be wrapped up. It seems to be making great strides in Canada as well with harvest in Saskatchewan at 5% complete and nearly 20% more ready to go.

In export news I see that Russia sold Egypt 60,000 tons of wheat at $190/ton. To give you an idea of our competitiveness that price is about $0.70/bu lower than where we are priced right now. Weekly export sales for the USA came in at 19.4 million bushels.

I also saw a report from the International Grains Council in which they estimated the world wheat production at 720 MMT versus their previous estimate of 710 MMT. The USDA currently has world wheat production pegged at 726.5 MMT.

Two of my three technical indicators are bearish both the Minneapolis and the Kansas City December futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%