Craig’s Closing Comments

August 28, 2015

I would certainly never pretend to place myself in the pantheon of great market analysts but since I do stick my neck out most every day and project where markets are headed I think it can be instructive to look at what other economic giants have predicted about markets in days past. As I look at the current economic situation these seem to jump out at me:

John Maynard Keynes in 1927: “We will not have any more crashes in our time.”

H.H. Simmons, president of the New York Stock Exchange, Jan. 12, 1928: “I cannot help but raise a dissenting voice to statements that we are living in a fool’s paradise, and that prosperity in this country must necessarily diminish and recede in the near future.”

Irving Fisher, leading U.S. economist, The New York Times, Sept. 5, 1929: “There may be a recession in stock prices, but not anything in the nature of a crash.” And on 17, 1929: “Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as (bears) have predicted. I expect to see the stock market a good deal higher within a few months.”

W. McNeel, market analyst, as quoted in the New York Herald Tribune, Oct. 30, 1929: “This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan… that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years.”

Harvard Economic Society, Nov. 10, 1929: “… a serious depression seems improbable; [we expect] recovery of business next spring, with further improvement in the fall.”

Corn:

I know I ought to be thinking about the corn market today but frankly all I can think about is cat juggling. Not sure why I have become fixated on that but I will guarantee you it is a lot more interesting than the corn market was today.

The anticipation of a big USA corn harvest coupled with weather conditions that are expected to be mostly favorable over the weekend kept the corn market under pressure today.

It certainly doesn’t help the market that the combination of a strong USA dollar and weakening South American corn premiums make it feasible to import South American corn into the USA. It is kind of sad that we can be trading this low and still face that possibility.

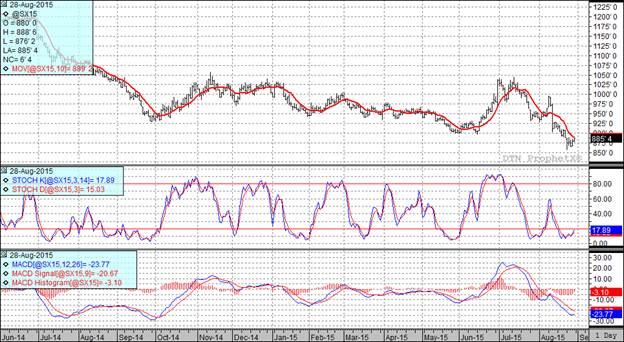

At the present time two of my three technical indicators are bearish both the September and December corn futures.

Soybean:

We had the soybean market trading higher today as traders expressed their concerns that the dryness in the Eastern Corn Belt coupled with next week’s warm up in temperatures could limit pod filling. It looks like some areas of the Corn Belt could use one last shot of rain to finish off the bean crop.

At the present time two of my three technical indicators are bearish both the September and November futures.

Wheat:

The sad truth is that USA wheat continues to be at a competitive disadvantage in the world market. Today we saw wheat from Ukraine sell into Egypt at a price that was $0.70/bu cheaper than the comparable offer from the USA. We are even hearing rumors that Russia is getting wheat sold into Mexico, business that usually comes to us.

The negative news led to selling which in turn triggered more sell signals and resulted in technical selling. I am not sure what is going to bring this market out of its death spiral.

Two of my three technical indicators are bearish both the Minneapolis and the Kansas City December futures.

This data and these comments are provided for information purposes only and are not intended to be used for specific trading strategies. Commodity trading is risky and North Central Farmers Elevator and their affiliates assume no liability for the use of any information contained herein. Although all information is believed to be reliable, we cannot guarantee its accuracy and completeness. Past financial results are not necessarily indicative of future performance. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%