Craig's Closing Comments

by Craig Haugaard

August 7, 2015

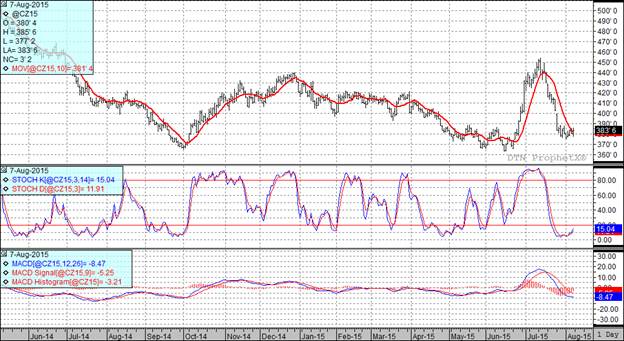

Corn:

We couldn’t get a decent rally going this week in corn which would seem to indicate that traders don’t think the weather or crop conditions are bad enough to build a risk premium into these futures prices. Right now we are seeing enough weather models with benign weather and “good” crop conditions reports that the market is just kind of in a blah state of mind with no real desire to beat the market substantially lower or to rally it substantially higher at this point. Maybe next week’s USDA report will provide the fuel to move us one direction or the other.

At the present time two of my three technical indicators are bullish both the September and December corn futures.

Soybean:

It seemed to be case of weather driving the market today. The current two week forecast is looking drier and that had the funds in buying today.

In the world of beans South America always carries a big stick. That will certainly be the case again this year, especially with the currency differences. The Brazilian Real continues to lose ground to the dollar, it is currently at a 13 year low, but for but Brazilian farmer it has been a real windfall as it increases the price they receive for their beans. Producers in Brazil are taking advantage of this having already sold 25% of next year’s crop compared to just 7% at this time last year. The net result is that we should continue to see more first crop beans with second crop corn. Analysts initially thought that we would see 1 to 2% of the acres move from corn to beans, but with the currency move it now appears that as much as 3 to 5% will switch. Toss in an El Nino weather pattern on top of those additional acres and we could very well see Brazil grow a record crop of soybeans, probably in excess of 100 MMT.

The aggressive producer selling in South America is having an impact on our new crop sales. As I pen these words the USA new crop export sales are down over 40% when compared to last year at this time.

Today’s strong performance now has two of my three technical indicators bullish both the September and November futures.

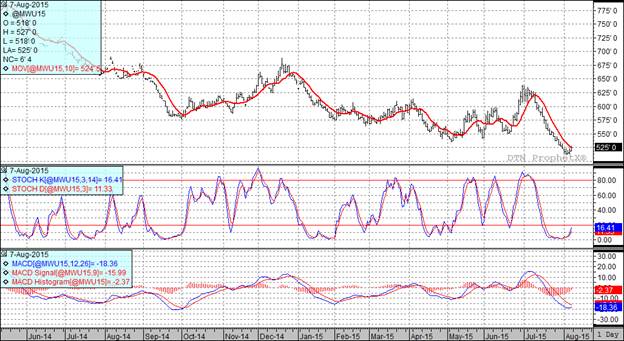

Wheat:

On the heels of yesterday’s good export sales numbers we had some weather related harvest delays that had buyers stepping up and buying wheat today. We should see harvest pick back up over the week-end and it is expected that when we get the crop progress report on Monday that it will show spring wheat between 15 and 20 percent harvested.

While we had good export numbers yesterday I did see that South Korean mills passed on two tenders for wheat, citing too high prices as the reason.

Looking around the globe it appears crop estimates for Australia, Canada, Europe and Russia have been creeping higher the past couple of weeks. It appears that the weather concerns that we had earlier in the growing seasons have been at least partially alleviated.

At the present time two of my three technical indicators are bullish both the Minneapolis and Kansas City September futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%