Craig’s Closing Comments

Craig’s Closing Comments

September 1, 2015

Corn:

We had a smattering of news to trade today. Outside influences weighed heavily on the market today with the news that the Chinese manufacturing data showed industry in that nation contracting at the fast pace in three years. That had our stock market on the defensive all session and pressed commodity prices lower as well. In other China related news I see that China’s corn price has dropped 20% in the past month. The Chinese government is also trying to lower the price of corn it pays to its farmers despite higher input prices. We are on a roll so let’s go for a third bit of Chinese news. Corn harvest in Brazil is 99% complete in Mato Grosso and 96% complete in Parana and Brazil is now offering corn into China at a level that is $0.25/bu cheaper than offerings from the USA.

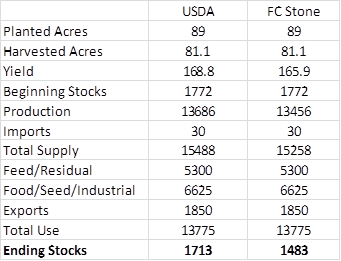

Last night the crop conditions came out and as expected reflected a seasonal reduction of 1% from last week. We had the funds selling 7,000 contracts today but at the end of the day I am personally getting to an area I would rather buy than sell from a pure speculative standpoint. After the close FC Stone released their September production survey and had the national average yield pegged at 165.9 bu/acre. I plugged that number into the most recent supply & demand chart and left the rest of the USDA numbers unchanged.

As you can see, this scenario takes the ending stocks to just under 1.5 billion. I think that the $3.60 area is about as low as this market should go based on a 1.7 billion bushels carry-out and would expect that if we see yields come in less than the current USDA projection we will see a rally at some point in the next few months. I just read the preceding sentence and realize how stupid it sounds. I basically just wrote that if the supply is less than expected the price will probably go up. Brilliant!!!!

I know we haven’t started harvesting this year’s crop yet but I see that according to a survey of Farm Futures producers, folks plan on planting 89.65 million acres of corn next year, up from this year’s 89 million acres.

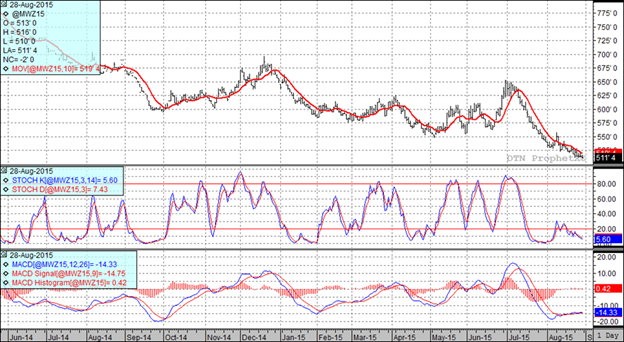

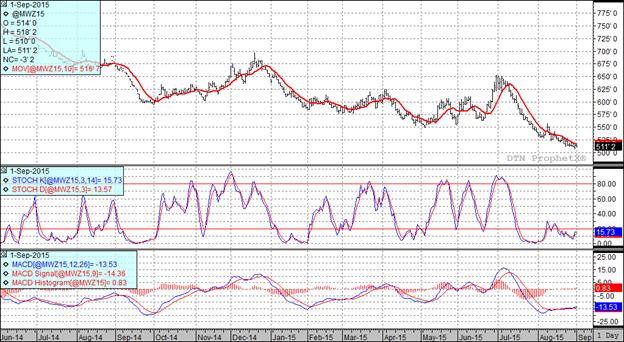

At the present time two of my three technical indicators are bearish both the September and December corn futures.

Soybean:

Crop conditions remained unchanged at 63% good/excellent. That, combined with the negative economic data from China pushed the market lower from the opening bell. The funds jumped on it and were estimated to have sold 8,500 contracts of soybeans during the session. It didn’t help that the Brazilian Real dropped more than the dollar, keeping us at an economic disadvantage to Brazil. As that nation gets closer to planting the next bean crop it still appears as if their acres will be up 2 to 5 percent over last year.

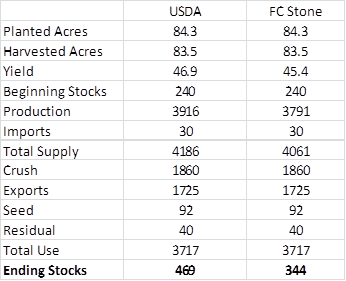

After the close we received the FC Stone projections. As you can see on the following table it leaves us with a pretty substantial carry-out. Rallies may be hard to come by in this market, especially if China continues to struggle.

A survey by Farm Futures projects that farmers will plant 86.32 million acres of soybeans next year. That’s up from this year’s 84.3 million acres.

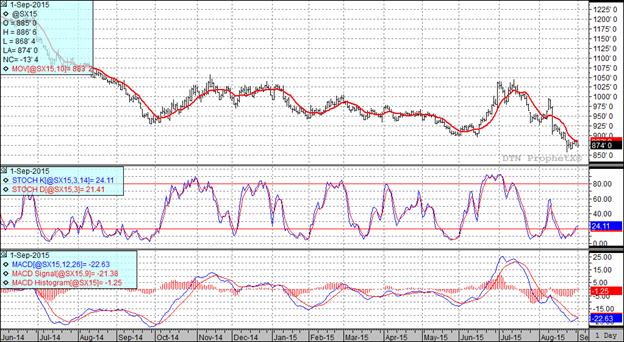

At the present time two of my three technical indicators are bearish both the September and November futures.

Wheat:

We had very little news in the wheat market today. Here in the USA spring wheat harvest is 88% complete, that’s 16% ahead of the five year average and 52% better than last.

On the demand side of the equation Egypt’s supply minister Khaled Hanafy said Egypt has enough wheat on hand to get them through mid-February. Russia and Ukraine have been grabbing most of that business but it is still negative to see them basically out of the market for the time being.

Two of my three technical indicators are bullish both the Minneapolis and the Kansas City December futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%