Craig’s Closing Comments

September 2, 2015

I was doing a little reading on the Roman Empire last night. I find it interesting that a politician named Clodius ran for the office of tribune on a "free wheat for the masses" platform and won. Not surprisingly by 45 B.C. one of every three Roman citizens was on “wheat welfare”. The Roman politicians didn’t stop there. This idea reached its final apex in the year A.D. 274. Emperor Aurelian, wishing to provide cradle-to-grave care for the citizenry, declared the right to relief to be hereditary. Those whose parents received government benefits were entitled as a matter of right to benefits as well. Aurelian gave welfare recipients government-baked bread (instead of the old practice of giving them wheat and letting them bake their own bread) and added free salt, pork and olive oil. Not surprisingly, the ranks of the unproductive grew fatter, and the ranks of the productive grew thinner. As we all know, the Roman Empire eventually collapsed; thankfully our politicians today are much smarter than those of ancient Rome and would never do something so irresponsible with our great nation.

Corn:

The day kicked off with some decent news as the weekly ethanol grind report indicated that 99.540 million bushels of corn were used in the production of ethanol last week. This leaves us needing to average 95.452 million bushels per week to achieve the USDA projection.

Export demand continues to be very weak and that is having an impact on basis. We saw the Gulf basis off $0.10/bu today as a result of the dismal demand.

I have been thinking about the FC Stone numbers that we discussed last night. Right now the trade seems to be trading a 168.8 bu/acre crop but if the FC Stone numbers are closer to the truth this market would seem to be setting up for a rally. We will have to see where yields actually come in to determine price direction from here.

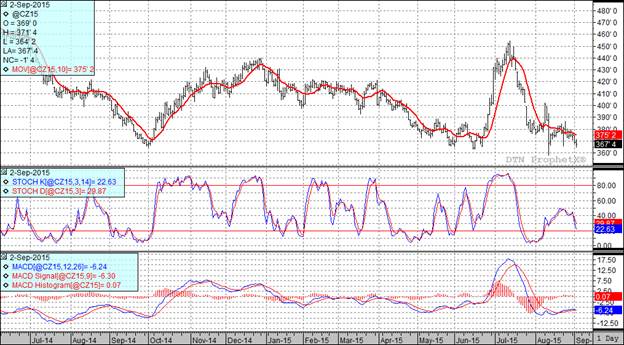

At the present time two of my three technical indicators are bearish both the September and December corn futures.

Soybean:

Really no fresh news today and we ended up trading on both side of unchanged and then settling the November futures right where we started the day.

As I ponder this market and try to determine what is next it occurs to me that perhaps we will play the acres game a bit more before this year draws to a close. In the August report we saw the USDA reduced harvested acres by 900,000 acres. With the FSA estimating prevent plant acres at record levels it seems to me that the surprise that may be lurking out there would be a further downward revision of the planted and harvested acres number. Barring that there is very little to make me excited about this market at the present time.

At the present time two of my three technical indicators are bearish both the September and November futures.

Wheat:

We set record lows in the futures today and we are still not competitive in the export market. The Russian Ruble was weaker again today and that coupled with prices that we already the lowest being offered in the export world will keep what business there is headed to their door. If there was still an active outcry trading pit for wheat I suspect the quote from Dante’s Inferno would be hanging over it, “Abandon all hope ye who enter here.”

Two of my three technical indicators are bullish the Minneapolis December futures while two of three are bearish the Kansas City December futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%