Craig’s Closing Comments

Craig Haugaard

September 3, 2015

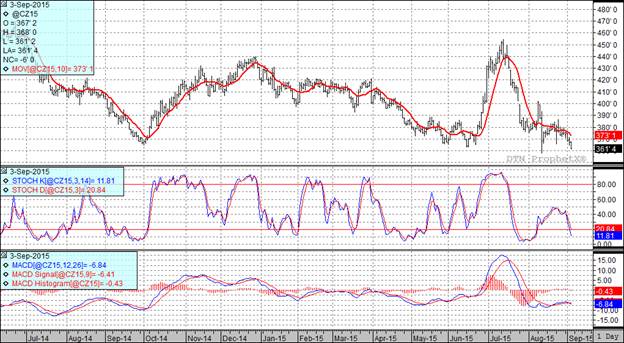

Corn:

Weekly export sales came in at 4.4 million bushels which was below the low end of the range of trade guesses and from there on out this market struggled today. At 10:30 this morning the new Informa numbers came out in which they pegged the national average yield at 168.8 bu/acre with a total production number of 13.688 billion bushels. That led to some aggressive selling and when the smoke cleared the funds had sold 8,000 contracts and we closed down six cents for the session.

With today’s price action I would expect that we will now test the December futures contract low at $3.57 ½ and ultimately test $3.50. Last year the low in the December futures was $3.18 ¼ which we reached on October 1st. A year ago we then staged a nice rally. It is a little too early to see if history will repeat itself.

With today’s action all three of my technical indicators are now bearish both the September and December corn futures.

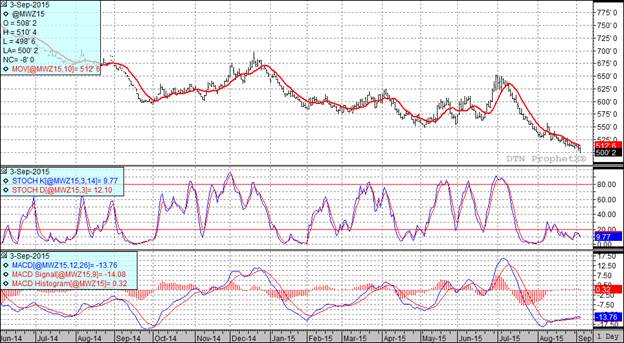

Soybean:

We started out stronger today on good export news but the market was then hit by an old fashioned one, two combination of punches. In this case the bearish combination was the Stats Canada report in which they projected their canola estimates at 2.3 MMT vs the average trade estimate of 1.4 MMT. The bearish info was followed by an Informa report in which they pegged the soybean crop at 47 bushels per acre with total production of 3.924 billion bushels. That was enough to turn the positive numbers we had been seeing back into red numbers as we traded lower into the close.

By the thinnest of margins all three of my technical indicators are bearish the November futures.

Wheat:

We kicked off the day with disappointing export news. The weekly number came in at 10.2 million bushels, less than what we need to average on a weekly basis to hit the USDA’s projection.

The StatsCanada numbers were sobering this morning as well, coming out 0.6 MMT larger than the average trade guess. Across the pond a private analyst increased their estimate of the Ukraine wheat crop by 1.5 MMT.

As if to rub salt in the wound we once again saw Russia sell wheat to Egypt at a price that is $0.50/bu cheaper than what we were offering SRW at. We also saw French wheat trade down 6.25 Euro’s/MT.

The net result of all this is that wheat complex put in life of contract lows again in all three markets, Chicago, Kansas City and Minneapolis.

Two of my three technical indicators are bearish the Minneapolis December futures while all three are bearish the Kansas City December futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%