Craig’s Closing Comments

September 8, 2015

Corn:

Strong outside markets and a weak dollar helped boost commodity prices today.

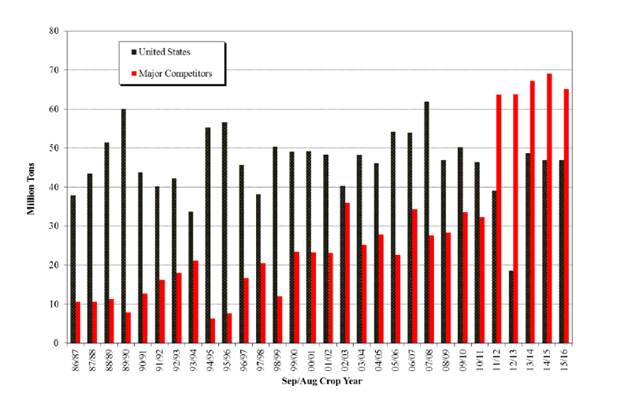

The weekly export inspections came in at 35.2 million bushels. The new crop year is just getting under way and we will need to average 35.5 million bushels per week to hit the USDA projection. It is worth noting that with the ethanol market not expecting any significant growth we need good exports to move the excess out of the market. The problem is that other exporting countries are in the same boat and have been doing a better job of capturing that market. The following chart does a good job of illustrating what has been happening in the export market.

The crop conditions report was unchanged at 68% good to excellent. The five year average is 54.2% good to excellent while last year at this point 74% fell into that category.

As we head into Friday’s USDA report the average guess from the Reuters survey was for a national average yield of 167.5 bu/acre and total production of 13.599 billion bushels. Bloomberg also had a survey in which they pegged the carryout for 2015-16 at 1.609 billion bushels and estimated the 2014-2015 carryout at 1.771 billion bushels. The production numbers don’t seem to fall in line with the early harvest results. More Yield reports coming from Illinois and Indiana are indicating yields below the USDA’s August forecast. For example, anecdotal reports show yields currently running 15 to 20% below last year in Central and Southern Illinois.

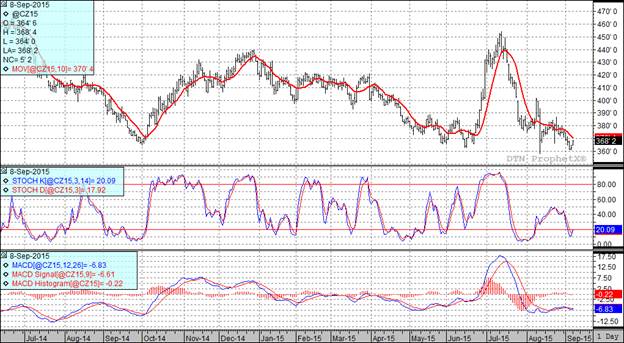

At the current time two of my three technical indicators are bearish the December corn futures.

Soybean:

In addition to the outside markets and weak dollar, beans were supported by the idea that the high temperatures may have had a negative impact on yield.

We kicked the day off with very disappointing weekly export inspection numbers. Coming in at 3.4 million bushels they fell far short of the 33.5 million bushels we need to average to achieve the USDA forecast.

After the close the weekly crop progress report showed the crop condition unchanged at 63% good to excellent, short of the 72% good to excellent enjoyed at this point last year but well ahead of the five year average of 55% good to excellent.

The Reuter survey has the national average yield pegged at 46.4 bu/acre with total production of 3.869 billion bushels. Bloomberg is projecting a carry-out of 424 million bushels for 2015-16, up from the 230 million bushel carryout they are projecting for 2014-15.

In international news I see that one private firm is forecasting Brazil’s bean crop at a record 100.9 MMT in the coming year. The USDA currently has them pegged at 97 MMT.

On the international demand side of the equation I see that the USA attaché in China is projecting their bean imports from the USA for 2015-16 at 30 MMT, unchanged from 2014-15. We will need to pick up the pace if we are going to achieve that since so far this year, China has booked only 5.4 MMT of soybeans from the USA for 2015-16 versus the 12.4 MMT they had booked by this time last year.

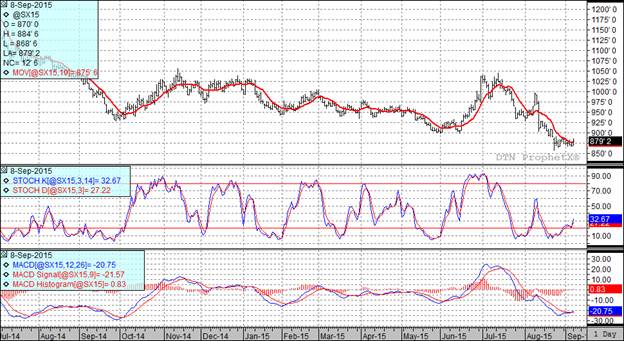

By the thinnest of margins all three of my technical indicators are bullish the November futures.

Wheat:

I hate to sound like a broken record but a weaker USA dollar and oversold conditions were cited as behind today’s recovery in the wheat market.

It certainly wasn’t good export numbers that popped prices today. Weekly export inspections were a paltry 13.6 million bushels. We need 17.7 million per week to hit the USDA export forecast. Exports to date total 5.4 MMT versus 7.1 MMT at this point last year. Our un-competitiveness in the world export market was highlighted once again today as Iraq bought 100 TMT of wheat from Canada.

On the bright side Russia’s IKAR lowered its wheat production estimate to 60.6 MMT from 61.8 but the USDA is currently assuming a 60 MMT figure for Russia so this is no real big win. We have been looking for weather problems around the world so it is worth noting that weather models are showing improved rain chances for the FSU winter wheat areas this week. If the forecast models are correct should shrink the areas of concern to only 15% of the wheat belt. We do still have the potential for problems in Australia where limited rains expected over the next two weeks in the East and Western Wheat belts of Australia.

Heading into Friday’s USDA report Bloomberg has the average estimate for 2015-16 carryout pegged at 868 million bushels.

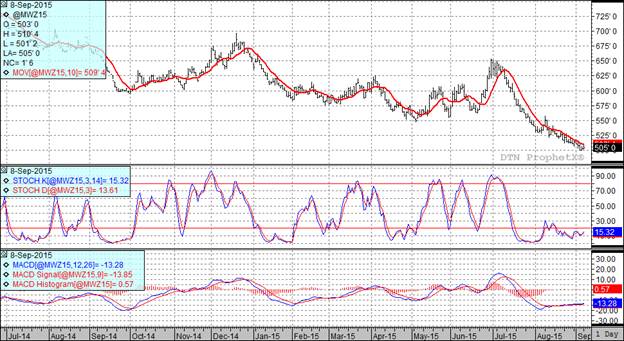

Two of my three technical indicators are bullish the Minneapolis and Kansas City December futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%