Craig’s Closing Comments

September 9, 2015

I find it interesting that on this date in 1776 the Continental Congress formally declares the name of the new nation to be the “United States” of America. This replaced the term “United Colonies,” which had been in general use. I am not all that sure that United applies to this nation anymore and I darn sure know I would trade the pack of clowns in Washington D.C. for men of the caliber that made up the Continental Congress in half a heartbeat. Well, before I become politically incorrect I better move on to the markets.

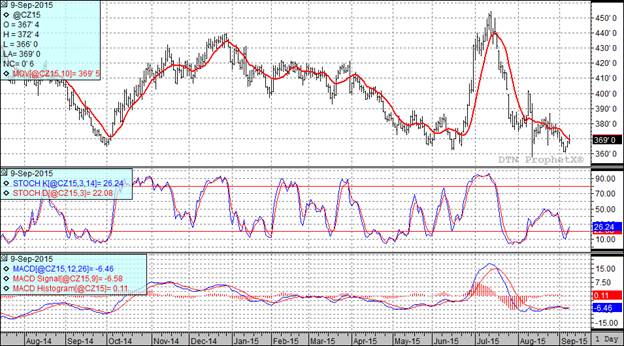

Corn:

Watching the corn market today was about like watching paint dry as we had a boring session in a tight trading range although we did manage to close a bit higher for the day.

Heading into Friday’s USDA report the average trade guess is that we will have a national average yield of 167.6 bu/acre and total production of 13.599 billion bushels. In August the numbers were 168.8 bu acre with total production at 13.686 billion bushels.

World carryover for corn is expected to be at 193.5 MMT, down a touch from last month’s 195.1 MMT.

The bottom line is that fall is in the air and traders have visions of huge piles of corn dancing in their heads. The conventional wisdom also seems to be that you will hold on to as much of the corn as possible which could create an interesting basis environment.

At the current time two of my three technical indicators are bullish the December corn futures.

Soybean:

I found it impossible to watch the soybean market today without thinking about the old movie, Animal House, and the classic scene in which an upperclassman tells a freshman, “My advice to you is to start drinking heavily.” I don’t want to encourage heavy drinking so I suppose I should also note that today is Teddy Bear Day. According to the Teddy Bear Day officials, “As we become adults, some find it difficult to give up our teddy bears. We feel there is no reason to give him up. Some adults have their teddy bears around all their lives. It’s perfectly normal....and okay.” I may have to disagree with them on whether it is OK for adults to sit around hugging a teddy bear but the way these markets have been I couldn’t blame folks if some of them were driven to that or to drink.

The trade had expected to see some slippage in the crop condition in yesterday’s report and when that didn’t happen I believe more traders started to conclude that we won’t see much cut in projected yields in Friday’s report. This realization led to some selling as funds were net sellers of 6,000 contracts during today’s session. We are starting to get some yield results from early harvest activity but it is all over the board. I suspect that in the next ten days or so we will start to get more accurate yield reports which could in turn determine market direction.

Speaking of Friday’s USDA report the trade is looking for a national average yield of 46.9 bu/acre with total production at 3.869 billion bushels. That is the same national average we had in August although total production is down slightly from 3.916 billion bushels.

Much of the pressure today seemed to come from Chinese news as we had unsubstantiated rumors that some Chinese soy crushers are unable to obtain financing. Chinese news also hit the stock market again today as the Chinese government changing its way it calculates GDP. Usually governments that change their key economic calculations are doing so to hide or correct some negative report. I know it is hard to believe that the Chinese could ever be anything less than open and honest but perhaps that is the case.

Two of my three technical indicators are bullish the November futures.

Wheat:

We didn’t have much fresh news in wheat today. Recently we have seen a slight increase in European wheat prices and traders were hopeful that would spark something in USA prices but so far that doesn’t seem to be the case.

As we head into the report there seems to be no hope that the burdensome supplies will be reduced. In fact the average trade guess is that we will have a carry-out of 868 million bushels, up slightly from the 850 million projected in the August report.

World carryout is expected to remain unchanged at the large August estimate of 221.5 MMT.

Russia was back in the news as the Russian government is considering removing or reducing export taxes on wheat. They are already kicking our butt so this is not good news.

Two of my three technical indicators are bullish the Minneapolis and Kansas City December futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%