Craig’s Closing Comments

September 10, 2015

I continue to believe that outside markets could exert a great deal of influence on the commodity markets. Today the news from the Asian markets was not good. We had poor economic data out of China and Japan overnight. China’s PPI in August was down nearly 6% when a decline of 5.5% was expected. Japan’s machinery orders were down 3.6% month over month when an increase of 3.7% was anticipated. We need good economic news from our trading partners and really haven’t been getting it.

Corn:

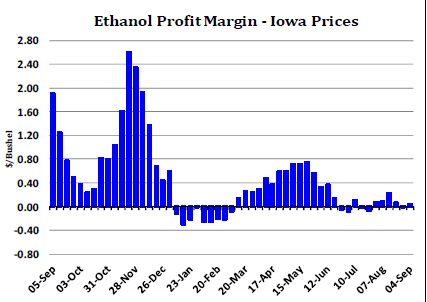

We kicked off the morning with the weekly ethanol report. Last week was a pretty solid week with 100.59 million bushels being consumed in the production of ethanol. Ethanol margins seemed to have tightened up but as you can see on the following chart of Iowa margins it is still profitable at the present time.

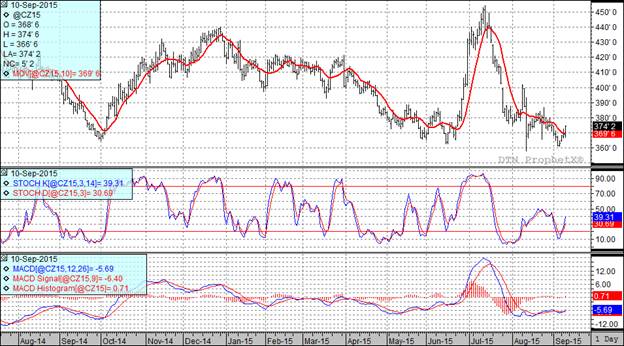

The market firmed up today as traders positioned ahead of tomorrow’s USDA report.

We continue to get early harvest reports coming in and thus far the reports seem to indicate that Illinois and Indiana are 15 – 20% below last year’s yields while in Missouri the yields are coming in as expected or a touch better.

It is probably a bit pre-mature to talk about next summer’s weather but we continue to hear reports that the Northern Hemisphere will experience a strong El Nino this winter. Since 1950 we have had eight El Niño’s of similar strength and in five of those years we have followed that up with a La Nino weather pattern. In three of those years we have seen yields come in under trend line yields. The most significant were in 1983 and 1988 where we harvested crops that were 78% of trend and 76% respectively. In 2010 we had this phenomenon as well and checked in at 94% of trend. If we had a 2010 type of year next year that would give us a national average of roughly 159 bu/acre and we would end up needing to do a little demand rationing. We have been saying it may take a weather problem to fix this market and if history is any guide that problem may show up next summer.

With today’s rally all three of my technical indicators are now bullish the December corn futures.

Soybean:

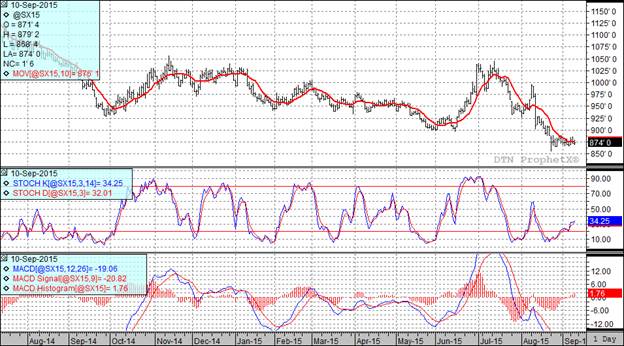

We had a very slow day in the bean pit with hedge funds ending up as net buyers of 1,000 bean contracts by the time the closing bell rang. In re-reading the preceding sentence I realize it is now all electronic so there is no bean pit and I am not sure there is a closing bell any more either but other than the bulk of the sentence being wrong the rest is correct.

Heading into tomorrow’s report the average trader doesn’t seem to be expecting any life changing news coming out of the report. I visited with some traders today who believe that the recent weather has been adding bushels in late maturing soybeans and should remain so with a rain system slowly shifting through the Eastern Corn Belt over the next few days.

Looking at the El Niño stuff I see that in only two of the eight years did we have a sub trend line yield in beans on the heels of El Nino. Those years, 1983 & 1988, had a real shipwreck for yields but the other six years posted strong numbers.

Two of my three technical indicators are bullish the November futures.

Wheat:

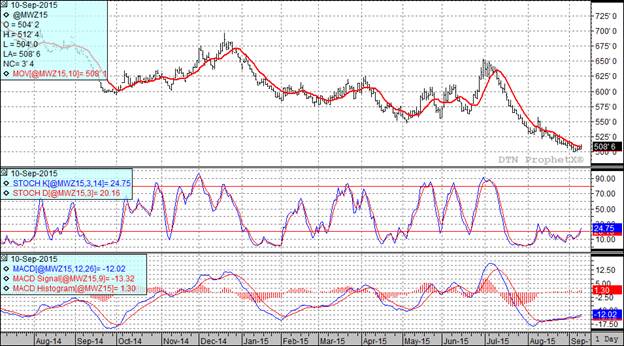

We saw some profit taking today as the funds were buyers of 3,000 contracts and folks lightened up ahead of tomorrow’s report.

The only other wheat related news I saw today was a little weather stuff. We had rain in the eastern parts of the Russian wheat areas which will help advance winter wheat planting. Australia expected to get rains in the Western wheat belt this weekend which will reduce the area of drought concern to less than 20% of that nation’s wheat belt.

With today’s close all three of my technical indicators are now bullish the Minneapolis and Kansas City December futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%