Craig’s Closing Comments

September 15, 2015

I know many of you will be heading to Big Iron this week so wanted to let you know that I will be part of a market outlook seminar at the Red River Farm Network tent on Wednesday, September 16th. The seminar kicks off at 1:30 and will run for an hour. If you are at Big Iron I hope you will stop by and say hi.

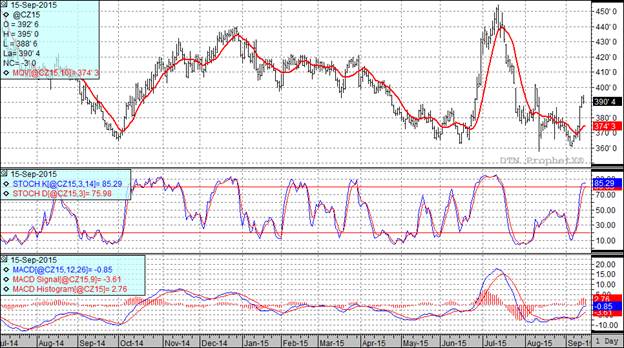

Corn:

Corn was unable to gin up any additional support on the heels of yesterday’s higher close and thus settled lower for the session.

As harvest has spread we continue to see variable yield reports. By and large they are below last year but as harvest expands it appears that yield reports are improving and may not be as bad as some traders are thinking. This led to funds being sellers of 7,000 contracts during today’s session.

All three of my technical indicators are currently bullish the December corn futures. Look for resistance in the December futures at $4.02 and frankly if I saw $3.95 again I may take a shot at selling it.

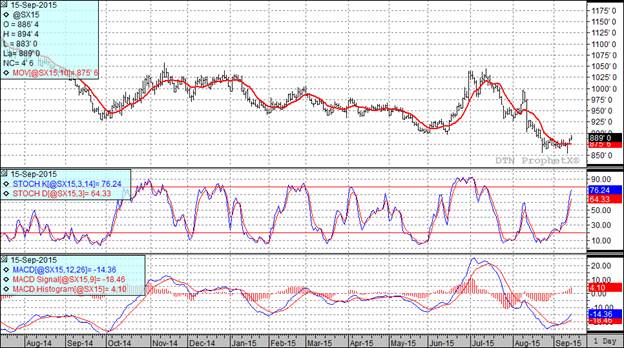

Soybean:

The soybean market received a little boost from yesterday’s crop conditions report which showed the conditions slipping by 2% from last week. This got us off to a stronger start and the bean pit never relinquished that bounce.

The August NOPA crush report was out today and estimated that 135.304 million bushels of soybeans were consumed in crush plants last month. This was almost exactly the number that the trade had been anticipating.

We are not seeing much harvest activity yet but some reports coming out of the Red River Valley north of Fargo seem to indicate that late season rains have once again helped yields.

At the current time all three of my technical indicators are bullish the November futures.

Wheat:

I have decided that if I ever again experience a wheat rally because of a freeze scare in Brazil I am going to sell the heck out of that rally.

Not only did the freeze scare seem to fizzle out but the market was also hit with news that the harvest in Russia is about 72% complete and at the same time that nation appears poised to revise its export duty. This will only make our efforts to compete in the export market more difficult.

Here in the USA we are seeing winter wheat seeding getting started. In most of the regions where winter wheat is being planted they are experiencing good soil moisture conditions.

All of this created a climate where funds were more willing to sell than to buy as they were sellers of 5,000 contracts of Chicago wheat during today’s session.

All three of my technical indicators are bullish both the Minneapolis and Kansas City December futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%