Craig’s Closing Comments

September 17, 2015

Perhaps the biggest news of the day came after the markets were closed. The Federal Open Market Committee decided to kick the can down the road once again as if left the Fed funds rate unchanged at near zero. Analysts are telling me that the announcement is bullish for stock index futures and is bearish for the USA dollar. On its face this would seem to mean that the USA dollar has topped out and should be bullish for commodities. While that is the conventional wisdom it was interesting to see the action in the DOW futures after the announcement. As expected the market shot up but then tuned and started trading lower so perhaps things don’t always pan out like the exports expect them to. The following chart is a 5 minute bar chart of the spot mini DOW futures contract which shows the initial rally and subsequent sell-off.

Corn:

I am sure that you have probably heard about the suicide bomber who was excited to detonate himself and be rewarded in paradise with 72 virgins. He followed through with his bombing but when he got to the gates of paradise George Washington met him at the gate. He slapped him across the face and yelled, “How dare you fight against the nation I helped conceive!” Patrick Henry approached, punched him in the nose and shouted, “You wanted to end our liberties but you failed!” James Madison followed, kicked him in the groin and said, “This is why I allowed our government to provide for the common defense!” Thomas Jefferson was next, beat the terrorist with a long cane and snarled, “It was evil men like you who inspired me to write the Declaration of Independence.” The beatings and thrashings continued as George Mason, James Monroe and 66 other early Americans unleashed their anger on the terrorist. As he lay bleeding and in pain, an Angel appeared. The bomber wept and said, “This is not what you promised me.” The Angel replied, “I told you there would be 72 Virginians waiting for you in Heaven. What did you think I said?”

That was kind of the way the day played out in these markets, one disappointment after another.

We kicked of the day with the weekly export sales report which, at 21 million bushels, was at the low end of trade expectations. Thus far we are running at 71% of last year’s commitments.

From there we moved on to the news that world values do not seem to support a major increase in USA corn exports. Since we are seeing the early pace of sales coming in less than what is needed to meet USDA projections this is not good news.

To add insult to injury it appears that corn basis levels have a weaker tone as well on the heels of good corn movement early in the week.

Finally, with harvest starting to pick up the funds appear to want a short position heading into and thus they were sellers once again today.

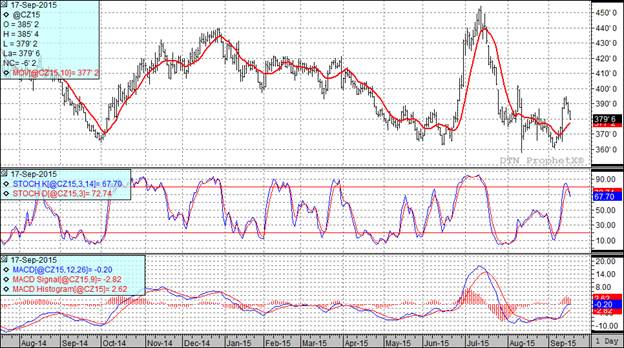

Two of my three technical indicators are currently bullish the December corn futures.

Soybean:

The weekly export sales came out at a solid 33.51 million bushels. Most of the business was with China but they continue to run at about 50% of what we would normally anticipate this time of year. We did have the announcement of an additional 298 tmt of business this morning so next week’s sales should also be good. We will have a Chinese delegation in the country next week and it is anticipated that they may sign some frame contracts.

While that is all positive news it is worth noting that a senior trader at Cargill is warning that China’s soy imports could fall for the first time in a decade.

Looking around the Corn Belt it appears that the extended forecast should allow for good harvest activity into the weekend and early next week and that could lead to additional pressure on prices.

At the current time all three of my technical indicators are bullish the November futures.

Wheat:

Export sales continue to disappoint with only 13.9 million bushels sold last week. As long as we have a strong dollar and ample world supplies we are going to struggle to mount much of a rally in this market.

I see that our neighbors to the north are about 70% done with wheat harvest. The last thing this market needs is more wheat competing for export business but that seems to be the future we are facing. Maybe La Nina will get rolling and we can gin up a good old fashioned drought in Australia to jump start this market.

Two of my three technical indicators are now bearish both the Minneapolis and Kansas City December futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%