Craig’s Closing Comments

September 21, 2015

It has been said that change is the only constant in life. As I sit down to put the closing comments together this afternoon, I find myself reflecting on that statement—perhaps because I am entering a season of change. I can’t begin to express how blessed I have been to work for NCFE, a cooperative that embraces the commitment to serving our patrons with the same fervor that I possess. I believe that it is this commitment between yourselves and NCFE that will allow us both to get through the current low price environment, and thrive well into the future. I have loved getting to know and work with the employees and patrons of NCFE. It has truly been one of the highlights of my career.

With that in mind, I find it very hard to leave, but I have been offered an opportunity that I just couldn’t pass up. So this will be my last week with NCFE. After having spent the bulk of my life in Minnesota and South Dakota, I find myself heading to the Eastern Corn Belt and a position within a cooperative in Ohio. While my heart remains in South Dakota, I will be a Buckeye for the foreseeable future and look forward to introducing those fine folks to my slow cousin Jimmy.

Before I do that, I want to take this last opportunity to thank you once again for the privilege of working with you these past years, and leave you with this Irish blessing:

May you always have work for your hands to do.

May your pockets hold always a coin or two.

May the sun shine bright on your windowpane.

May the rainbow be certain to follow each rain.

May the hand of a friend always be near you.

And may God fill your heart with gladness to cheer you.

Corn:

After trading lower in the overnight session we were able to jump start the markets during the day session.

The weekly export inspections report was out this morning and showed 29 million bushels of corn inspected for export last week. This was in line with the trade expectations. We did have the sale of 500K MT to Mexico reported this morning which helped support prices.

Looking at the demand picture from a longer time frame it will be interesting to see how the ethanol game plays out. With low oil and gas prices and blend margins that may actually be negative it is possible that we may not see much more than the mandated levels used. For 2015 that translates to 4.8 billion bushels and 5 billion in 2016.

After the close we had the crop conditions and harvest progress reports. The condition is unchanged from last week, holding at 68% good to excellent. A year ago 74% of the crop was in that category while the five year average is 54.2% good to excellent.

Tomorrow is turn around Tuesday and based on this afternoons reports I would not be surprised to see it trade lower on the morrow.

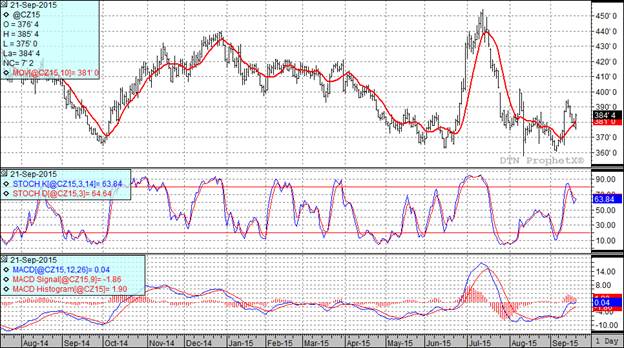

Two of my three technical indicators are currently bullish the December corn futures.

Soybean:

Weekly export inspections came in at a solid 18.5 million bushels, actually just a touch above the top end on the trade estimates. Shortly after that report came an announcement that the mythical “unknown” had purchased 240,000 MT of beans. That, coupled with the fact that a Chinese trade delegation is in the USA and is expected to sign some ceremonial export sales agreements offered support for today’s session.

Looking to the South we did have some temporary good news out of Brazil where their ag inspectors are on strike. If it continues for a bit it could delay so exports out of Brazil which could help us but unfortunately most people expect this to be resolved quickly.

While we are talking about South America, I know I covered it last week but it bears repeating that Safras said total soy production for the new crop is going to come in at 100.54 MMT, up from their July projection of 99.8MMT. In 2014-15 Brazils farmers produced a record 95.5 MMT of soybeans. If Safras turns out to be correct it will be the 3rd record production in a row for Brazil. They are just starting to seed in some portions of Brazil and with the way the Brazilian Real has collapsed versus the dollar, down 16% in less than a couple of months, we are seeing the prospect for even more soybean acres than had originally been projected. We will want to keep a very close eye on how things develop in the Southern Hemisphere.

After the close we had an interesting crop conditions report in which the condition actually improved by 2% over last week, moving from 61% good to excellent to 63% good to excellent. Harvest is starting to pick up with 7% of the crop now harvested. This is right in line with the five year average and slightly ahead of the 3% posted at this date last year.

At the current time two of my three technical indicators are bearish the November futures.

Wheat:

The weekly export inspections came in at 22.2 million bushels, just above the top end of the range of trade guesses. The export inspections coupled with some fund short covering helped propel the market higher for the session.

Also supportive to wheat were stories of drought coming out of Russia and Ukraine. At this stage of the game it appears that about 25% of Russia’s wheat belt is experiencing drought conditions and that area is expected to grow.

Finally, it is worth noting that while we are still priced too high to be competitive in the export market the export trades that I saw today were $4 or $5/MT higher than what traded last week.

All three of my three technical indicators are now bullish both the Minneapolis and Kansas City December futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%