Craig’s Closing Comments

September 22, 2015

It is a crazy world out there. If the markets aren’t crazy enough for you we can always count on the United Nations. Earlier this year Saudi Arabia’s Ministry of Civil Service had eight executioner positions advertised on their website. Apparently business has been good and they need extra people to help keep up with all the public beheadings and amputating the hands of convicted thieves. I know they like to administer lashes to people as well but I don’t know if that was a part of these jobs or if public lashing is done by a different government agency. Maybe their equivalent of the IRS. Anyway, the reason I mention this is that the other day the United Nations picked Saudi Arabia to head up the Human Rights Council. My slow cousin Jimmy probably said it best when he remarked to me last night that, “Awe the cwazy? This is like naming Bill fweakin Clinton head of the Amewican Abstinence and Celibacy Association.” Not a bad point. Just when I think the markets are crazy I don’t have to look too far to see events that make them seem tame.

Corn:

The market is facing good crop conditions and great harvest weather into early October. That is all it took to have the market on the ropes for the session today.

We also had some outside pressure on the market with the DOW getting a good old fashioned beating while the dollar was stronger and crude oil was weaker. Between good crop conditions and negative outside influences the market never had a chance today.

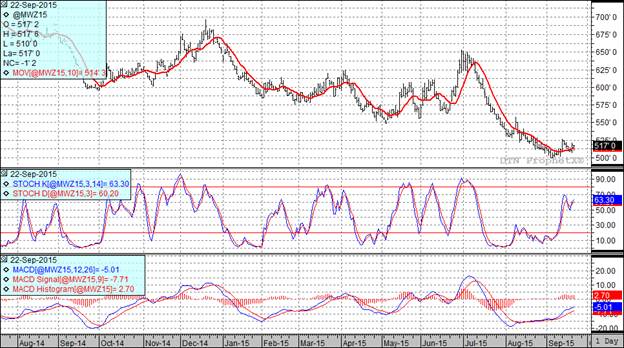

Two of my three technical indicators are currently bearish the December corn futures.

Soybean:

While we are getting rolling on harvest here, they are starting to plant in South America. They are just getting going with 1% of the South American crop planted. The expectations are still that we will see soybean acreage increase by 3-4% because of the high cost of planting corn.

Here in the USA the harvest reports coming out of the Eastern Corn Belt are pointing to better than expected yields.

Increased South American acres and better than expected USA yields are a one, two punch that may keep bean prices knocked down for some time.

At the current time two of my three technical indicators are bearish the November futures.

Wheat:

We continue to see some weather stories in the wheat market. Of concern to some is the fact that growing areas of Australia have been experiencing dryness. The other day I mentioned that Russia was facing some drought conditions and the weather forecast for Russian wheat doesn’t seem to be improving. In spite of that I see that they are still the cheap player in the export market with Russian wheat penciling into Brazil.

It appears that wheat may be trying to find a bottom but without help from the row crops may struggle to do so.

All three of my three technical indicators are currently bullish both the Minneapolis and Kansas City December futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%