Craig’s Closing Comments

September 23, 2015

I was sad to see that Yogi Berra has passed away. As a tribute to him the following are some of my favorite Yogi Berra quotes:

1. When you come to a fork in the road, take it.

2. You can observe a lot by just watching.

3. It ain’t over till it’s over

4. It’s like déjà vu all over again.

5. No one goes there nowadays, it’s too crowded.

6. Baseball is ninety percent mental and the other half is physical.

7. A nickel ain’t worth a dime anymore.

8. Always go to other people’s funerals, otherwise they won’t come to yours.

9. We made too many wrong mistakes.

10. I usually take a two-hour nap from one to four.

11. Never answer an anonymous letter.

12. The future ain’t what it used to be.

13. It gets late early out here.

14. Pair up in threes.

15. Even Napoleon had his Watergate.

16. He hits from both sides of the plate. He’s amphibious.

17. It was impossible to get a conversation going, everybody was talking too much.

18. I don’t know (if they were men or women fans running naked across the field). They had bags over their heads.

19. I’m not going to buy my kids an encyclopedia. Let them walk to school like I did.

20. It ain’t the heat, it’s the humility.

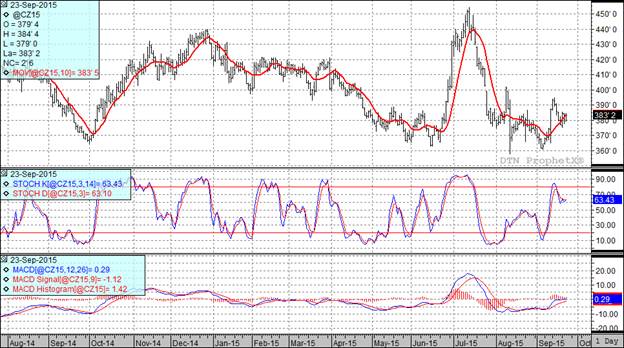

Corn:

We saw the corn market trade both sides today as it picked up some support from the wheat market. We are seeing harvest activity pick up around the USA and thus far the yield reports are coming in better than expected although not as strong as last year.

The only real news we had today was the weekly ethanol report which showed a slowdown in demand. Last week 98.49 million bushels of corn were used in the production of ethanol. We need to average 100.726 million bushels per week to achieve the USDA projection so hopefully this dip is short lived.

Two of my three technical indicators are currently bullish the December corn futures.

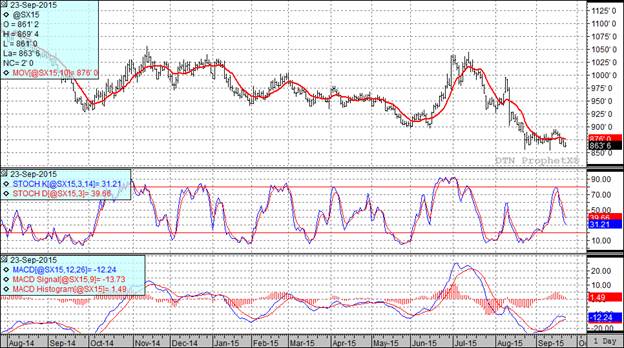

Soybean:

I know that we have discussed the Brazilian REAL and the role that the softening of that currency will have on the expansion of Brazilian bean acres but I was reminded of that again today as we saw the REAL hit an all-time low against the dollar. At one point today the Brazilian REAL traded to 4.15 per USA dollar. Since the start of 2015 the REAL is down 34% versus the dollar. What that has done to prices is beautifully illustrated in the following chart where the red line is the price of nearby bean futures while the black line is the prices of nearby bean futures in reals. You can see that up until the start of the year we were tracking fairly closely but when the REAL started to collapse versus the dollar things got ugly. Looking at this chart it is easy to understand why bean acres are expected to be at a record level in Brazil this year.

The bean market was the beneficiary of spill over support from the bean market as well as from the expectation that tomorrows export sales will be fairly large. On the other hand, at some point this market will have to confront yield reports that seem to keep getting larger every time we turn around. Without exception, the yield reports that I am seeing are getting larger as harvest activity picks up and that is not good news if you are trying to be bullish.

At the current time two of my three technical indicators are bearish the November futures.

Wheat:

Wheat was the lead sled dog again today as we saw fund short covering and spreading against row crops.

The continued concern over dryness in Australia and parts of the Ukraine and Russia was given as the reason funds and large speculators were covering some of their short position. If we just step back and look at the world fundamentals they continue to appear negative so I suspect this rally is really providing us a good selling opportunity.

We also saw some spread activity today as traders were buying wheat and selling corn.

All three of my technical indicators are currently bullish both the Minneapolis and Kansas City December futures. If I had some spring wheat left to sell I would probably look at moving some if we hit the price levels in the Minneapolis December futures that are highlighted on the following chart.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%