Craig’s Closing Comments

September 24, 2015

Since I have announced that I am leaving I have been contacted by a number of you wondering how to stay on top of the technical indicators that I have been sharing with you the past few years. You can access the charts with the technical indicators that I use by going to the NCFE home page, http://www.ncfe.coop/Home and then clicking on the chart that is located on the right side of the futures quotes. If you want more information on how to use these technical tools a good resource can be found at the following location: http://www.amazon.com/CRAIG-TRADING-Haugaard-Trading-Championships%C2%AE-ebook/dp/B00WT2CO7Y

Corn:

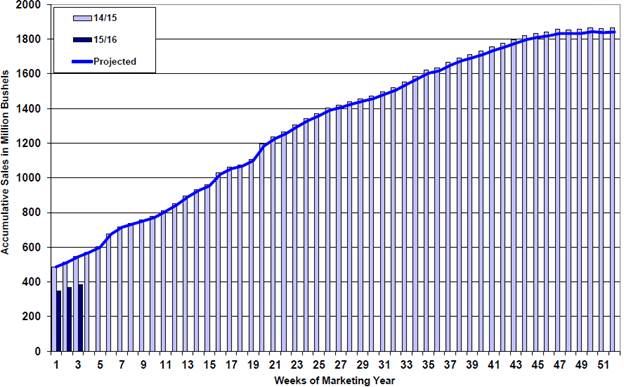

We kicked off today’s session with the weekly export sales report. For the week we came in at 16.8 million bushels, below the low end of trade expectations. The following chart will give you a good visual picture of where we are in export sales now compared to last year as well as to where we need to be to achieve the USDA’s projections. Although it is very early in the export year there is no doubt that we need to pick up the pace.

I mentioned a while back that the Brazilian Ag inspectors were going to go on strike. In fact they did go on strike and remain so this week, as corn vessels waiting to load begin to back up. In spite of this logjam we continue to hear rumors of Brazilian corn being shipped to the East Coast of the USA. It also appears that some cheap feed wheat from Eastern Europe may be making its way over as well. The rumors are certainly acting as a damper on price activity.

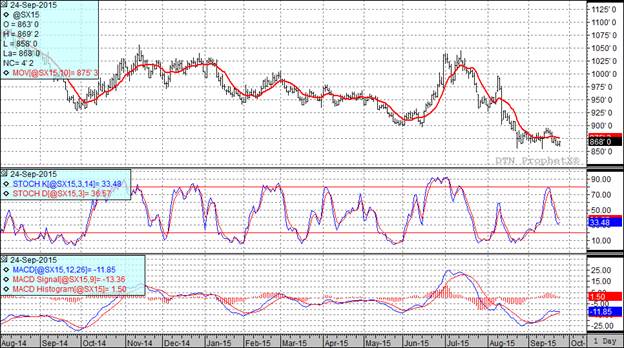

Two of my three technical indicators are currently bearish the December corn futures.

Soybean:

Encouraging demand stories were the key to this market today. We kicked off the morning with a good weekly export sales report. The USDA reported that last week exports sales totaled 48.4 million bushels. This was above the top end of trade guesses and got the market off to a stronger start. Mid-morning the USDA reported that another 313 TMT had been sold to our old buddy “unknown.” From there we closed out the day with the announcement that China had signed a total of 24 frame and sales contracts. According to Reuters this deal has them buying 13.8 MMT over the 2015 and 2016 marketing years. A picture of the ceremony is below.

Once we got past the export news there was very little to talk about. Obviously, harvest is continuing to progress and thus far the yield reports have been very good which tends to limits gains.

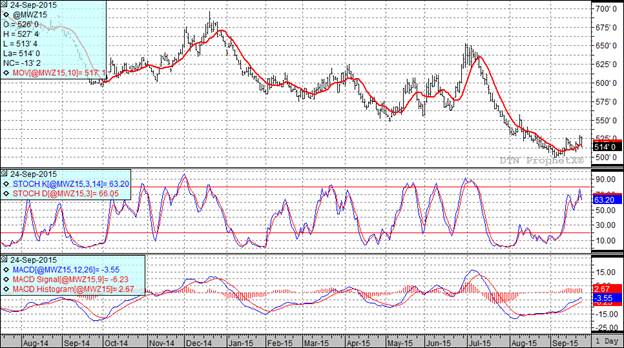

At the current time two of my three technical indicators are bearish the November futures.

Wheat:

It still hasn’t rained in Russia but the trade no longer seems to care. In spite of the continued talk of dryness in Australia and parts of Ukraine and Russia the market was unable to move higher today. That seemed to focus the market back on the burdensome domestic and world supplies and once that happened the path of least resistance was lower.

The weekly export sales were terrible, checking in at a mere 10.4 million bushels. We have fallen below the pace needed to achieve the USDA projections and unless we suddenly become more competitive in the export market we may very well fall short of the current projection.

Today’s price action turned two of my three indicators bearish the Minneapolis December futures while, by the slimmest of margins, all three of my indicators are still bullish the Kansas City December futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%