Closing Comments

Lynn Miller

September 30th, 2015

Corn:

Closing unchanged today after Stocks numbers that were ‘as expected. Trade’s estimate was 1.739 and the number came in at 1.731. Over all for the month of September December corn gained $0.27. Some reasons could be less S.American acres and hints of less than ideal weather in 2016. But no matter what other pieces you through at it, this market is still supply and demand driven over the long haul. Continued higher prices will depend on export demand and US useage.

Export sales tomorrow guessed to be 700-900mt vs 426 last year. China issued grain import quotas equal to last year at 7.2mmt. Ethanol production is up 5K barrels per day whiles stocks declined (both good news).

Technically all three indicators survived the day and remain in bullish territory vs.December corn. An inside day yesterday and an outside day today, does this mean we are in for a technical sell off? The stochastics climbed even closer to overbought. We are trading above both the 10 and 50-day (red) moving averages. My price objectives have not changed at $3.94, $4.06, $4.18 and at the top end of the range $4.29. We have now touched that $3.94 twice in the past week another reason I think this market is looking to correct. I’m still ok with $4.05 to make a sale on harvest delivered bushels (about $3.35 cash at Craven).

Soybeans:

To say that I was disappointed with the market’s reaction to supportive numbers in the Stocks Report today is an understatement. The market traded higher right into that report under the impression the USDA would adjust the 2014 production. So they reduced yields by 0.3 bu/acre and they gave us a stocks number of 191 vs the trade guesses 205 and we still traded down right after the release?

So the question then becomes, where do we start for 15/16 stocks? Condition ratings have eroded slowly, but steadily. Looking forward the trade is likely to lean more bearishly with reports of record yields and won’t be positioned for an unchanged or lower yield adjustment in October. This could be a smoking gun come the next USDA report on the 9th.

Technically, all three indicators survived a report day and managed to stay on the bullish side. Not only that, we are solidly approaching the 50 day moving average (red) and a potential change in trend. I’m still skeptic this market with the Chinese sales last week not being posted (or smaller than believed), a big crop coming and talk of slower demand I’m personally not ready to bank on a run. $8.00 was a good price target yesterday, but today I’d probably want a few more cents. I’d be willing to price harvest bushels today at $8.10 (Craven bid) rather than paying DP charges of $0.05/month when we only have a $0.02 carry to January. Other target level for condo and binned bushels would be $9.28 and $9.50 futures.

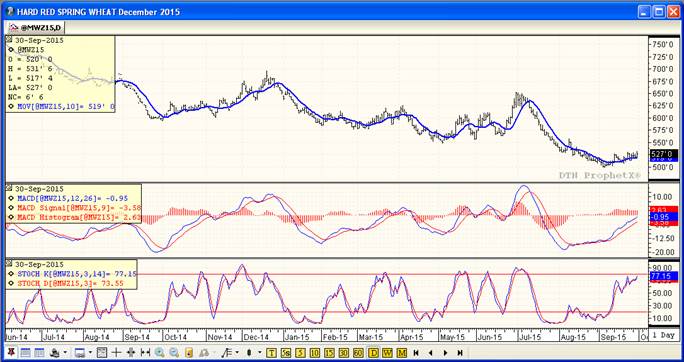

Wheat:

The USDA was good to us today, giving ending stocks of 2.089 vs the 2.149 that was expected. They reduced overall production from 2.136 to 2.052 for starters. We could derive that the feed residual was actually higher than expected at 291 vs 283. All of this was short term good news.

Dry weather remains on the minds of traders with rain needed in the US, Australia and Russia.

Technically all three indicators continue to just barely hang onto the positive side for the December Minneapolis futures. This market is braced for the worst today and then we got some support number. We will have to see if the momentum can power through and take us higher. Support should hold @ $4.99 with selling targets at $5.35, $5.58 and $5.76.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%