Closing Comments

Lynn Miller

October 5th, 2015

Corn:

Strength in beans, ideas of fewer US harvested acres, pre-report positioning and some seasonal buying all piled on the market to help corn near recent highs.

Weekly export inspections were not wonderful, coming in at a mere 18.5 million bushels, down from 31.9 last week and well below the 35.0 number from last year. The boat line up in Brazil is growing, now 98 vessels waiting to load, this is 70 ships more than 1 year ago.

For those trying to make a plan to price binned bushels, the spreads are strengthening again slowly. If you want to roll December futures you’ll want to keep an eye on these.

Technically all three indicators are once again positive the December corn futures. I’m hoping that the fact we are trading over the 100-day moving average will give us some momentum to maybe climb out of our rut. Still though, my price objectives have not changed, $3.80 should hold as support in the short term with selling levels at $3.94, $4.06, $4.18 and at the top end of the range $4.29.

Soybeans:

The past two months beans have been stuck in a rut ranging form 8.50 to 8.95, but the market sentiment maybe leaning more bullish. The 15 year seasonals indicate this week as an important turning point in soy futures. Here’s hoping we can see some gains.

Closing higher again today with strong export sales keeping visions of record demand in the forefront and thoughts of reduced acres all playing into the rally. Export inspections this morning at 41 million bushels vs. 37 last year and higher than expected. Season to-date we are at 94 million bushels vs 92 last year.

If you are looking to forward pricing binned bushels or thinking about rolling November futures, you will want to keep an eye on the spreads. These are weakening slightly. You will want to pay attention.

Technically, two of three indicators continue to be bullish the November futures. That trend line is our nemesis right now, and will prove to be a strong point of resistance for now. The stochastics did tip up today in neutral territory and maybe signaling some more buying. My price objectives remain at 8.99, 9.27 and 9.50. However, I am still willing to price $8.00 (Craven bid) or better beans rather than pay DP. As of tonight’s session down trend resistance will be at 8.96 ½. Another point to consider, with the spreads wanting to weaken I’d be willing to use a Basis Fixed contract in place of paying DP charges for some of this year’s beans.

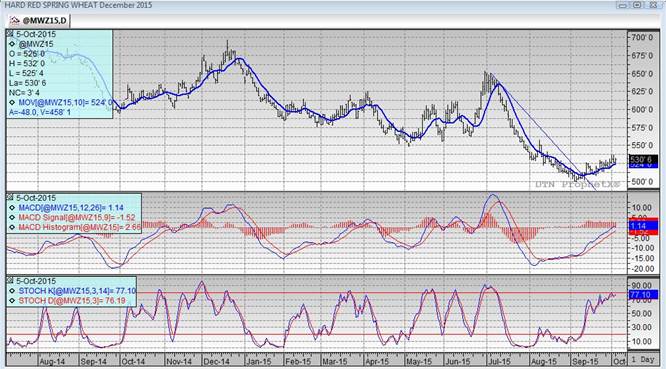

Wheat:

A choppy wheat session today that ended a few cents higher on little to no news. Export inspections today were actually within the trade guess at 20.5 million bushels vs 23.4 last week.

Egypt bought 235,000 mt of wheat in a tender this week, with the majority from Russia. The US remains too expensive, what was bought went for 199.75/mt + freight, US Wheat is bid at 236/mt with freight.

Technically, all three indicators are once again bullish the December Minneapolis futures. As for a support, the main level is back to contract lows at $4.99. My selling targets have not changed, still at $5.35, $5.58 and $5.76. The idea is to get bushels priced when opportunity presents itself. The spreads in the Spring Wheat market remain strong, so we should be able to capture carry after the initial sale.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%