Closing Comments

Lynn Miller

October 8th, 2015

Closing Comments

Lynn Miller

October 8th, 2015

Corn:

Values week all session as the funds were unable to generate any interest into a bullish position coming into tomorrow morning’s report. Overall, the consensus seems to be for a slightly reduced yield plus reduced planted and harvest acres. Some think production could be lowered as much as 100 million bushels. I don’t think in the bull camp with both feet, but will agree that good numbers could be enough to push over the $4.00 hurdle. I’m not sure if we can maintain that level during the heat of harvest.

Export sales were slow at 519.7 tmt vs. 785 tmt last week, with commitments running 28% behind last year. Harvest continues to advance rapidly with another week of wonderful weather in the forecast.

Technically, two of three indicators remain slightly bullish the December corn futures. The stochastics have issued a sell signal. $3.94 did not hold today and set us back to support of $3.80. Selling targets really haven’t changed: $3.94 is still a good selling point with $4.06, $4.18 and $4.29 on the high side.

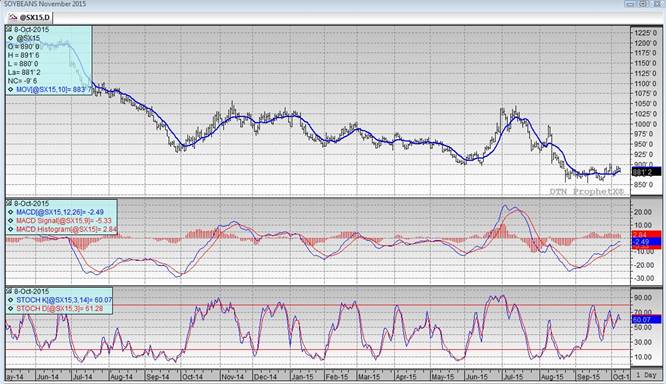

Soybeans:

Bean harvest is ticking right along and with it some outstanding yield reports, especially in the Western Corn Belt. The trade is confused coming into this report. Most are expecting higher yields, but the question is will the acre reduction be enough to generate upward momentum?

Export sales were at the top end of expectations this morning at 1284.6 tmt sold vs 923.4 last year. We still lag in commitments 26% behind last year.

Technically, two of three indicators have now turned bearish the November futures. The only indicator remaining bullish as of the close is the MACD. Support is the dependable $8.54 while my price targets have not changed. I still think $8.00 cash beans (Craven bid) is a good place to sell harvest bushels. While upwards pricing targets would be $9.28 and $9.50.

I am leaving this in here so you can all absorb this as a potential marketing strategy – a way to avoid accruing DP charges in a market that is expressing very little carry right now.

An explanation of how this Basis Fixed contract works and why I think it’s the way to go with a portion of your beans. So here it goes:

Setting basis on delivered bushels will stop storage charges so let’s look at a scenario setting basis against the March futures at Craven.

If we were to DP these beans we would pay 5 months of storage (Oct –Feb) and that would cost us $0.25/Bu.

Today’s basis bid is -0.85. If we set against the March the carry in the futures market is $0.08. Since we cannot gain carry in a basis situation our basis will widen to -0.93; however, this buys us until February 15th to price these bushels.

($0.25 – $0.08 = $0.17 better to you.)

There are a couple questions to ask yourself when making this decision:

1st do you think futures will rally between now and your pricing date of Feb 2016?

2nd do you think basis will improve more than $0.17 in this timeframe?

Another factor that might sway your decision is that you can advance on Basis fixed bushels.

Wheat:

Wheat just continues to be a non-event with no new news and no follow through. Weather issues continue in the FSU and Australia. Export sales numbers were within range, but still small in scale to what we need to catch up to the USDA projections.

Egypt is tendering wheat tonight, but don’t look for the US to be a player.

Technically, two of three indicators remain ever so slightly bullish the December Minneapolis futures. The stochastics are issuing a sell signal and we closed right at the 10-day moving average. The only indicator remaining positive is the MACD. The contract low of 4.99 continues to be our main support and my selling targets have not changed either at this point: $5.35, $5.58 and $5.76.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%