Closing Comments

Lynn Miller

October 12th, 2015

Corn:

Today was a pretty slow paced, slightly negative day with no news. The USDA is closed for the holiday so we won’t see export inspections or crop progress until tomorrow. Many in the market place are expecting a variety of storage methods to show up this year as they feel the farmer will hold this crop just as long as they can. The cost to bag corn is approximately $0.20/bushel, quite a bit lower than six months of DP charges. Of course you will need to know all pros and cons of this type of storage before implementing it.

Technically, all three indicators have turned bearish December corn. The stochastics are screaming their way down to an oversold signal, hopefully this will be a minor technical correction and we can work our way back up again. We closed right on support of $3.80. We’ll hope this holds tomorrow. $3.94 is still a good selling point with $4.06, $4.18 and $4.29 on the high side.

Soybeans:

A strong showing in beans today, just to fizzle out into the close. One point to interest, the Chinease Yuan has hit a 2 month high against the dollar and has retraced 75% of the devaluation mover earlier this year. US basis off the PNW remains the best bid for China and soy purchases continue. Brazil and Argentina are currently off the market with no bids until Febraury. Even in February, the US is competitive against South America. Seems like these are words we haven’t heard in a long time.

Technically, all three indicators are bullish the November futures by the thinnest of margins. Support remains at $8.53. I would my eye on $9.00 futures. This is going to be a mental game here, don’t miss out on the sale. Targets above $9 would be $9.27 and $9.50.

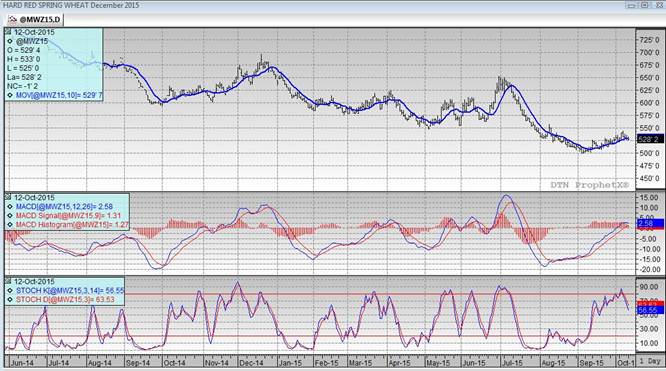

Wheat:

A choppy session with no story to give it direction allowed wheat to wander lower. About the only thing we had to think about today was the 740 tmt sale to Saudi Arabia from Friday night. This is an interesting global sale. It allows the Seller to source wheat from Canada, the European Union, North America, South America and Australia.

Technically, two of three indicators are now bearish the December Minneapolis futures. The MACD is still the only indicator holding on. The contract low of 4.99 continues to be our main support and my selling targets have not changed either at this point: $5.35, $5.58 and $5.76.

Top Trending Reads: