Closing Comments

Lynn Miller

October 13th, 2015

Corn:

Not a lot of excitement in the corn market today as we were pulled higher on the coat tails of beans and meal. This market is conflicted: bears think US supply is on the rise due to larger crops and smaller demand. Export sales today supported the theory at a mere 22 million bu vs18 million last week, considerably below the trade guess. The bulls are insistent most of this bearish data is already priced into the market and that substantial farmer holding will drive prices up after harvest.

Technically, all three indicators remain bearish December corn. The stochastics are hooking, but it will take another day or two to pull things out trouble. $3.80 has proved itself to be a pretty solid level of support. I feel $3.94 is going to a tough row to hoe when we get there so I am still willing to sell it. I would also be looking at $4.06 and $4.17.

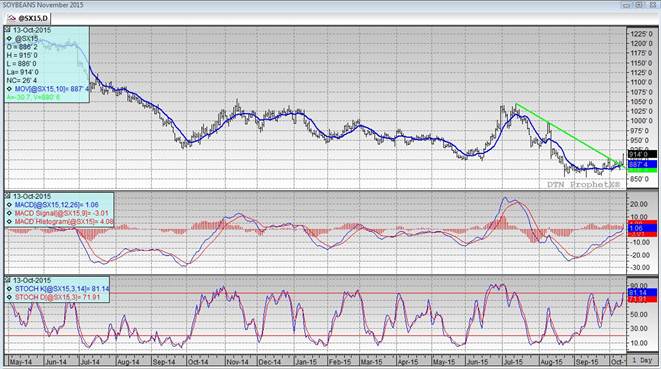

Soybeans:

What a difference a day makes, from doom and gloom yesterday to hope in beans today as we ended sharply higher and over key resistance. I was out of the office Friday and apologize that I didn’t catch that we had traded over trend line on Friday and Monday. If I had notice that I might not have been as surprised as I was over today’s gains.

Several fundamental factors are play in the market all of a sudden. First off, exports were very good at 67 million bu vs 42 last week. China buying remains strong with hog margins near record highs. Some talk China is buying futures to lock in margins and inquiring about Nov/Dec/Jan beans from US origin. Second, the market is watching the weather in S. American. Specifically, the potential for an El Nino to lead to severe dryness and cut planted area. And third, is simply the technical repositioning of the funds.

The question now is can the fundamental bulls get enough legs under this thing to get the technical traders (or should I say funds) to buy in?

Technically, all three indicators are aggressively bullish the November. Today’s price action may have move support up a notch to 8.99 if we can hold it. This has changed my price objectives slightly. We could be looking at a gift and +27 is hard to pass on, so if you are behind in sales of have DP bushels letting a few go here is a good idea. My price objectives above this area are now $9.27, 9.49 and 9.72 (which I think is a reach). I would be looking to price at $9.27 as I feel we will hit that and then go through a technical downward correction.

Wheat:

Still not much going on in the way of news for the wheat market. Some talk of dryness in the Southern US winter wheat country. El Nino concerns are also spilling over into the wheat market adding support. It’s interesting to note the European wheat futures did not follow the US rally today.

Technically, all three indicators have turned bullish December Minneapolis futures. Support has moved up to $5.35 on today’s action. Now the question is can we find anything to help us stay here? My selling targets have not changed either at this point: $5.35, $5.58 and $5.76.

Top Trending Reads: