Closing Comments

Lynn Miller

October 14th, 2015

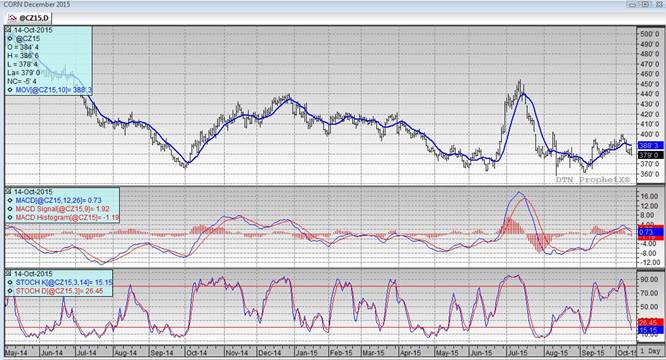

Corn:

Just a slow, negative day in the corn world as the focus was on crop conditions (68% good to excellent) harvest progress (42% vs. 27% last week and 43% on average) and the updated FSA acres, which gave us nothing new to trade. So, we are focused on large Midwest yields with nothing else to trade.

Weekly ethanol stats will be out tomorrow, export stats to be released on Friday thanks to the holiday. Values have become cheap enough in Brazil to nearly work into the SE US markets, just need another 10-15 cents. How weird is that, on a record year we could be importing?

Technically, all three indicators remain solidly bearish December corn. The stochastics have made a strong run to over-sold territory making me wonder just how much they are willing to take out of this market. $3.80 did not hold as support today, I’m hoping we’ll see some support around 3.73 now. We did put in an outside day today, right here at support, so we could see this as a bullish change in trend. I’m still of the opinion $3.94 is going to be a tough row to hoe when we get there so I am still willing to sell it. I would also be looking at $4.06 and $4.17.

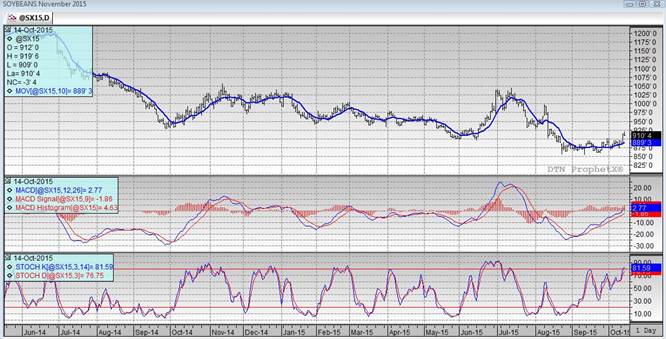

Soybeans:

Not the explosive follow-through today that everyone was hoping to see, but we did hold comfortably over the $9.00 mark which to me is a win in its own right.

NOPA crush numbers out tomorrow with expectations of 129 million bushels, which would be the largest September number since 2008. China was a buyer of 235 tmt of beans yesterday. Export numbers; however, are delayed until Friday. Harvest was 62% complete last night vs 54% on average. El Nino continues to be a concern; however, we cannot predict the impact this weather pattern might have on Brazil. Yes, they are dry now, but water is in the forecast and conditions could change. Keep this in mind as you are looking for selling opportunities, if S. American weather make a turn for the better, our prices will most likely drop.

Technically, all three indicators are aggressively bullish the November. The stochastics are trying to tip in over-bought territory, so don’t lose sight of your price objectives. This has been a nice rally, that deserves a sale in my book. My price objectives remain unchanged from yesterday $9.27, 9.49 and 9.72 (which I think is a reach). I would be looking to set in offers at $9.27 futures as I feel we will hit that and then go through a technical downward correction.

Wheat:

Wheat was on the defensive as progress numbers came out. Winter Wheat planting 64% complete vs 66% average while emergence is at 33% vs 36% average. Obviously the dry conditions in the Southern US have not hampered progress much at this point. This market needs some news to trade!

Technically, all three indicators are now bearish December Minneapolis futures. $5.35 did not hold as support today, putting $4.99 back in the picture. We seem to becoming really range bound here between $5.25 and $5.45, just a narrow $0.20. My selling targets have not changed either at this point: $5.35, $5.58 and $5.76.

Top Trending Reads: