Closing Comments

Lynn Miller

October 15th, 2015

Point of interest: Investment money making a return to commodities. Not only in Corn, Beans & Wheat but also sugar, cotton, coffee and cocoa. El Nino fears and continued limited prospects in alternative investments have sparked interest for now. While this interest could fade, it’s been helping support the agricultural sector the past week.

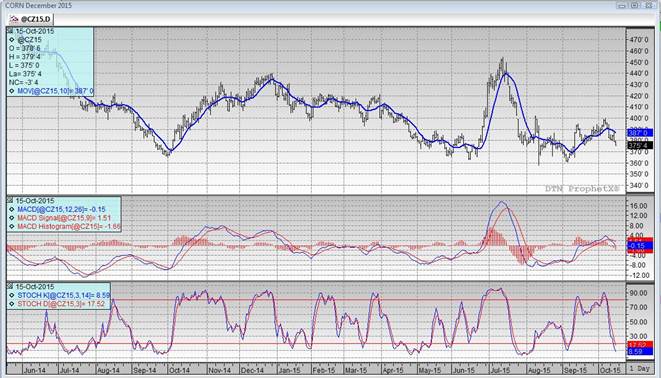

Corn:

Corn continues to struggle against pressure from a harvest that is ticking along relatively uninterrupted. Weekly export production was down from last week but still above last year. Ethanol stocks are up from last week and last year while margins remain soft. Export sales numbers tomorrow. The trade is looking for 450-650 mt vs. 519 last week.

It may not be a bad idea to be looking forward to 2016 production at this point. I see the December futures are trading at $4.04 on the close, not so sure a few bushels here wouldn’t be warranted. If your not ready to make sales, maybe we should be looking at some target levels to try locking in some profits if we can find it.

Technically, all three indicators remain solidly bearish December corn. The stochastics are now solidly into oversold territory at only 8.59. $3.73 managed to hold as support during todays’ session. I’m still of the opinion $3.94 is going to be a tough row to hoe when we get back there so I am still willing to sell it. I would also be looking at $4.06 and $4.17.

Soybeans:

NOPA crush numbers were out this morning at 126.7 million bushels vs. the trades expectation of 129. This smaller number didn’t slow us down much for the 1st half of the session as thoughts of increased demand stayed center stage. Export sales released tomorrow. Trade expecting 1,000-,1,500 mt vs. 1,285 last week. US farmer selling remains light.

We are approaching futures expiration next week when you will have to decide wether to set basis or roll contracts forward. Please keep an eye on the spread. Nov-Jan right now at $0.03 ¾ and the Nov-March is at $0.07. With very little carry it might be worth it to set basis and make delivery so you can move onto corn.

Technically, all three indicators remain bullish the November, but they are slowing down quickly. The stochastics have tipped just shy or 80 and are crossing to issue a sell signal. This has been a nice rally that deserves a sale in my book, if you are sitting on DP bushels, consider getting something sold her rather than paying DP charges in this flat market. My price objectives remain unchanged at $9.27, 9.49 and 9.72 (which I think is a reach). I still believe we will see $9.27 futures, I just don’t think it will be a straight line to get there.

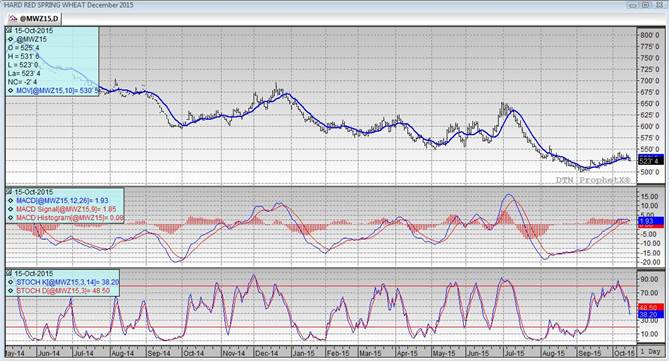

Wheat:

We just can’t get any new news in the wheat market. All we have right now is a weather game, will it or will it not rain. When you take weather out of the equation we are left simply with a large amount of wheat the is uncompetitive in the world market. Export sales tomorrow expected to be 250-450 mt vs 288 last week.

Technically, two of three indicators are bearish December Minneapolis futures with only the MACD hanging in there today. $4.99 is once again the main line of support. We settled just at the bottom side of this narrow range we were settling into $5.25 and $5.45. My selling targets have not changed either at this point: $5.35, $5.58 and $5.76.

Top Trending Reads: