Closing Comments

Lynn Miller

October 16th, 2015

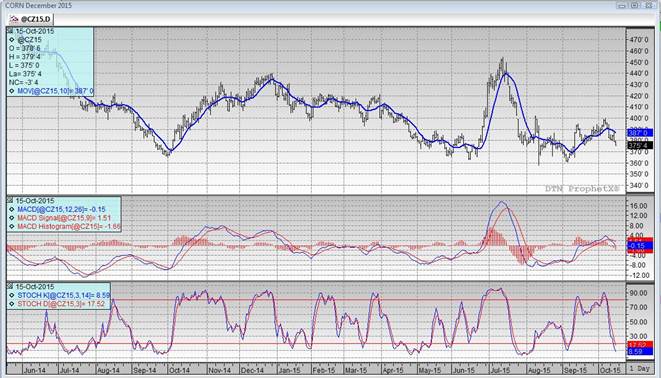

Corn:

There are a lot of fundamental factors at play in the corn market all of a sudden. Higher prices earlier this week were supported by slow farmer selling, long liquidation has been linked to concerns of deflation and reduced demand, good harvest weather. Some feel we are at a point of seasonal support that could help us once this harvest starts to wrap up. Lower livestock prices and soft ethanol margins offer some price resistance.

Export sales today were good at 598.4 tmt (top end of the trade guess).

Technically, all three indicators remain bearish December corn. However, the stochastics have tipped upward in oversold territory. This may be the leading indicator, but it appears we may see this issue a buy signal early next week. $3.73 managed to hold as support during todays’ session kind of – we closed at 3.72 ½ so we are close and this isn’t math so we should be good. The more days we struggle the more intent I am to make a sale at $3.94, it is going to be a tough row to hoe when we get back there so I am still willing to sell it. I would also be looking at $4.06 and $4.17.

So, Informa was out with 2016 acreage and production numbers today. They are predicting 90.8 million planted acres and production of 14,079 million bushels. Yes, it is a guess, but the market will trade these numbers until we have something to tell us otherwise. Informa increases acres this in 2.4 million more acres this than year and 526 million more bushels in an already inundated market. So I am ready to look at protecting 2016 profits now. ADM and a couple others were recommending sales of up to 30% 2016 production at $4.03. I’m not quiet that bearish yet, but I think we need to keep it in mind. Looking at the following retracements I would be willing to offer 10% at $4.12 and 10% at 4.20 as we wait and see how this plays out.

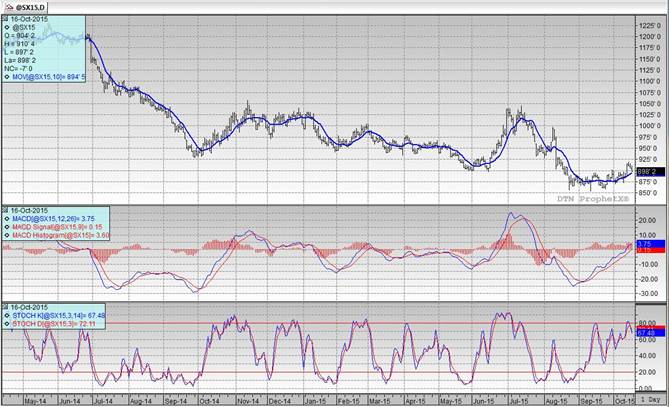

Soybeans:

Choppy session in beans with better weather forecast for S. American planting adding a bit of pressure after all the talk of El Nino this week. Export sales; however, were smashing at 1.47 mmt, the top end of the trade guess and over last year’s 0.935 for this same week.

Informa’s look at 2016 brought us 83.9 million acres and 3,848 in production vs. 83.2 this year and anticipated production of 3,888. No huge changes, but economics is favoring retaining bean acres at the moment with the corn/bean spread hanging in there at 2.35.

Technically, two of three indicators remain bullish the November, but they are slowing down quickly. The stochastics have issued a sell signal. My price objectives remain unchanged at $9.27, 9.49 and 9.72 (which I think is a reach). I still believe we will see $9.27 futures, I just don’t think it will be a straight line to get there.

Wheat:

Early gains in wheat gave way to double digit losses as we head into the weekend. Some reasons for the sell-off could be overall slow export demand, huge global stocks, improved weather forecasts for the southern US plains and Russia.

Export sales today were actually pretty good at 460.4 tmt, comparable to last year’s 454 tmt. However, we continue to run 18% behind last year’s pace with translates to 2.2 mmt less in exports year for year.

Informa’s 2016 acreage number was 54.0 down from 54.6 this year; however production was still up at 2,120 million bushels vs. 2,052 this year.

Technically, all three indicators have now turned bearish the December Minneapolis. $4.99 continues to be our main line of support with first level of resistance at $5.35. Additional selling targets would be $5.58 and $5.76.

Top Trending Reads: