Closing Comments

Lynn Miller

November 2nd, 2015

New Trading limits took effect this morning:

Wheat - $0.35

Corn - $0.25

Soybeans - $0.60

Corn:

Corn values at their best at the day session open and just simply fell from there. Couple things on the minds of traders are the harvest progress (expected to be 85% tonight) lack of farmer selling and poor export performance. Today export inspections were 477.4 tmt. This puts marketing year shipments at 5.4 mmt and 25% behind last year’s pace. Many believe the reduction in exports is unmistakable and assume it will need to be addressed in the next Supply & Demand report November 10th

.

Argentina corn planting is nearing 40% completion. A vested interest in the country’s presidential election is slowing the planting pace. One candidate favors removing export taxes, which would stimulate more plantings if he were to win the election.

Technically, all three indicators are once again bearish the December corn. This market is like a yo-yo and terribly hard to read. The good thing is the sideways range is maintaining, that bad this is open interest is decreasing which may give the bears room to take the next leg down. Current support levels $3.75 and then back to $3.58. I continue to believe $3.94 is a very sellable level, I do not however, believe it will be a long lived opportunity next time it presents itself. If you’re really bullish you could look at $4.06 and $4.17 after that.

Soybeans:

A firm open and good export inspections didn’t mean much today as we closed near the day’s lows. Inspections were released at 2.56mmt for last week. Total inspections now 9% ahead of last year’s pace. Yes China remains a hungry active buyer, but the trade is getting tangled up in stories about sluggish manufacturing there.

We may have setup for nice pop tomorrow on a turn-around Tuesday; however, without some kind of weather scare reasons to maintain any significant rally are lacking.

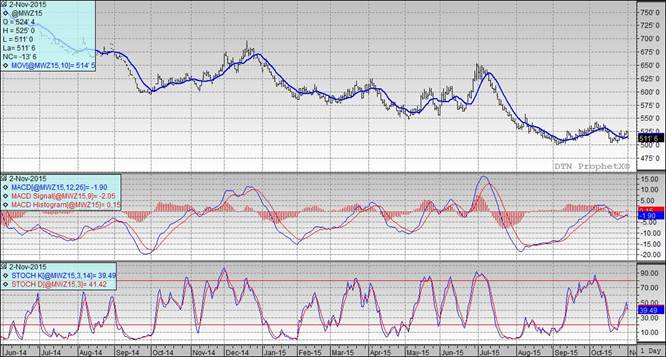

Technically, all three indicators are bearish the January futures. Even though the stochastics haven’t signaled for us yet, they are in deep oversold territory which should lend for some technical buying at some point here. Support continues at $8.57 on the down side with selling points at $9.02, $9.31 and $9.54. I’m still looking to sell at anything above the $9.00 futures mark. This is a good sale under the current market conditions, nearby basis improvement just adds a little extra to it.

Wheat:

Heavy selling from the get go in all wheat complexes today. Good moisture received over the weekend was also bearish. Export inspections were poor once again, just a broken record in this department. 170,993 mt was the number and it fell short of not only this week’s expectation, but also below last year’s numbers. The US fails to be competitive even at these levels. Most of the business is going to Canada, France and the Former Soviet Union. It’s a real possibility we could see export demand lower here on November 10th as well.

One story is slowly developing in the Ukraine. Only 86% of the expected winter wheat acres were seeded due to dry weather that halted germination. While this isn’t a problem yet, this crop will need better winter and spring weather to even generate an average crop. This is something to keep in the memory banks as we move forward.

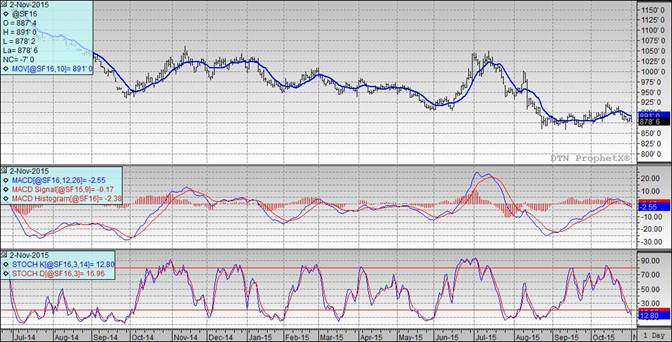

Technically, again all three indicators are once again bearish the December Minneapolis futures. The stochastics have moved to a sell signal in neutral territory. $4.99 continues to be our main line of support and resistance levels remain the same tonight with my selling targets at $5.35 and $5.58 and on the high side $5.76.

Top Trending Reads: