Craig’s Closing Grain Market Comments

December 31, 2014

I hope everyone has a safe and Happy New Year. My slow cousin Jimmy has invited me to his New Year’s Eve party tonight and as much as I don’t want to go I think I will head over there to keep an eye on him. He has a rich history of making bad decisions and New Year’s Eve seems to really bring that out in him. A couple of years ago he decided to try snorting Coke. After the fact he told me he didn’t understand how people could get into that. He said getting the straw up his nose was tough and when he took a big snort he said he almost drowned plus all that carbonation really screwed up his sinuses. I told him I didn’t think he had the right kind of coke to which he replied, “Do you think I should have tried Diet Coke instead?” I wasn’t at that party because a couple years prior I had attended and that was enough to scare me away for a while. Jimmy had been reading on all the New Year’s traditions that various countries have and he decided to combine a bunch of them to guarantee himself a very successful New Year. It was the strangest hodgepodge of events I had ever heard of but oddly enough when Jimmy gets excited about something he can be pretty persuasive. At about 11:30 that evening he got up and announced his plans to all 21 guests and wrapped it up with a very heartfelt, “Guys this wiww be gweat. You’ww nevew fowget it, pwus I’ww havw weawwy gweat wuck aww yeaw.” How could you turn him down after that? I kind of felt like a darn fool but Jimmy had read that running around the outside of your house banging pots and pans together would scare off the evil spirits and bring good luck so right after his speech we all grabbed pots and pans and headed outside for a sprint around his house while banging our pots and pans and whooping at the tops of our voices. By the time that we got back inside some of the neighbors were starting to get a little upset. The next activity was similar in that he had read that the Irish believe that banging loaves of bread on doors and walls will chase the bad luck out of a house and to invite good spirits in so no sooner had we gotten back inside than Jimmy was passing out loaves of bread and asking us to smash them against his walls. You would think that you could smack bread against a wall quietly but it turns out that this was a pretty loud activity as well. What happened next is the one that still has me scratching my head. Jimmy had read that in Johannesburg, South Africa it is a tradition to throw furniture out the window so sure as heck after the walls got a good bread smacking he took a bunch of us upstairs where we proceeded to toss his Easy Boy out a second story window. In retrospect we should have opened the window first but we kind of got caught up in the excitement and overlooked that step. This led to the grand finale which was going to be the Puerto Rican tradition of throwing water out of the window. It was about 20 below zero that night and Jimmy had a 10 galloon pail of water which he tossed out of the upstairs bathroom window. Unfortunately by that point all of the noise had resulted in the neighbors making some phone calls and a couple of officers were standing at the front door, which in a twist of cruel fate is located directly below the upstairs bathroom. I don’t really want to talk about what happened next but suffice it to say that I have not been back to one of slow cousin Jimmy’s New Year’s Eve parties since. Hopefully your New Year’s will be wonderful but not as eventful as that one was.

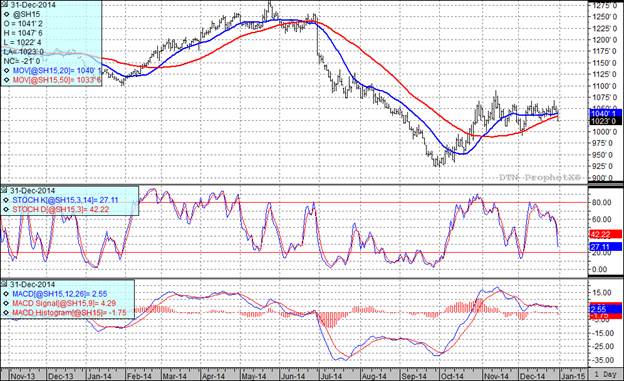

Corn:

The only fundamental piece of news that I saw today was the weekly ethanol production report which showed 102.06 million bushels of corn being used to produce ethanol last week. That is down 2.1 million bushels from the previous week but certainly much stronger than the 98.855 million bushels that we need to average weekly to achieve the USDA’s annual projection.

While that news certainly can’t be painted as bearish there is no doubt that the bears were running the show today. The only plausible answer that I can come up with was that we were seeing end of the year long liquidation in full force today. With long’s being liquidated we pressed the market down enough to trigger some additional technical selling and that in turn allowed us to close below both the 20 day moving average as well as the $4.00 level in the March futures. If it wasn’t the end of the year I would be more concerned but considering the timing I would not be surprised to see the market close higher when trade resumes on Friday. If we see more follow through to the downside on Friday I will start to change my thinking.

All three of my technical indicators are bearish. I had been expecting this market to fill the gap at $4.26 but am giving up on that any time soon. A lower close on Friday would turn me into a raging bear.

Soybean:

The weather in South America looks real good for the foreseeable future so that was probably a bit negative but the real story seems to have simply been that it was the last trading day of the year. As the year came to a close we saw long liquidation and, as noted in the corn comments, that triggered technical selling. Funds were net sellers for the day as 2014 staggered off into the sunset.

Today’s action turned all three of my technical indicators bearish the March futures as we traded toward the bottom of the recent range. It is interesting that we closed below both the 20 and 50 day moving averages today. That could generate follow through selling on Friday although my personal bias remains that we will see a higher session to open the New Year.

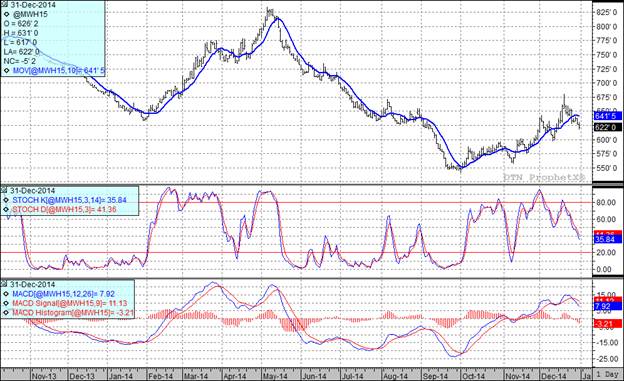

Wheat:

With Russia out of the headlines the market seems to be back to focusing on large world supplies and the USA’s relative un-competiveness in the export markets. Toss in the end of year liquidation and we had the wheat market on the ropes all day today as well.

The only real news that I ran across was out of Australia where the 2014 – 2015 harvest is drawing to a close in Western Australia’s Great Southern region. It looks as if harvest for this region will come in at 3.4 MMT which is the second largest crop in history, just falling short of last year’s record of 3.6 MMT.

All three of my technical indicators are currently bearish both the Kansas City and Minneapolis March futures.

Further Reading:

This data and these comments are provided for information purposes only and are not intended to be used for specific trading strategies. Commodity trading is risky and North Central Farmers Elevator and their affiliates assume no liability for the use of any information contained herein. Although all information is believed to be reliable, we cannot guarantee its accuracy and completeness. Past financial results are not necessarily indicative of future performance. Any examples given are strictly hypothetical and no representation is being made that any person will or is likely to achieve profits or losses similar to those examples.

Confidentiality Notice: This email and any files transmitted with it are confidential and intended solely for the use of the individual or entity to whom they are addressed. If you have received this email in error you must delete it immediately from your system. You should not disseminate, distribute or copy this e-mail. If you are not the intended recepient; taking any action with the contents of this email, other than immediate deletion, is strictly prohibited.

North Central Farmers Elevator - 12 5th Ave. Ipswich, SD - 605-426-6021.