Craig's Closing Comments

by Craig Haugaard

August 14, 2015

I am a little worried about my slow cousin Jimmy. He has always been impulsive and sometimes jumps into stuff without thinking. Earlier this week I jokingly wrote that we should pull out the ergot, put it in baggies and sell it at the farmers market in Portland, OR. I certainly didn’t think anyone would take that seriously but earlier today I got a call from Jimmy. That darn fool read my comments, hopped in his pickup and headed to Portland to try and develop that market. This afternoon I got the following picture from him with a note that these were his new friends and that we has pretty sure they would be more than willing to try ergot as well as help market it. I don’t know where this is going but I have this feeling it is not going to end well. I will keep you up to date as I hear from slow cousin Jimmy and his attempt to develop a market for ergot.

Corn:

The corn market was a very slow sideways trade in a very narrow trading range.

The trade continues to keep an eye on the weather and in today’s midday report the five day forecast got a little wetter with a system that is supposed to move through the region Sunday through Monday. The 6 to 10 and 11to 15 forecasts also suggest a pattern of above normal temperature and precipitation.

On the demand side of the equation the USDA issued its feed outlook today. In the report they raised the grain consuming animal units (GCAU) for 2015 to 95.2 million units. This is up 2 million units (animal equivalents) from last year yet they are keeping the level of feeding year over year at 5.3 billion bushels of corn. I am sure that in Washington D.C. that makes perfect sense.

Growing conditions continue to be tough in Europe. In a report out today the crop conditions in France were dropped from 58% good to excellent last week to 55% good to excellent in this week’s report.

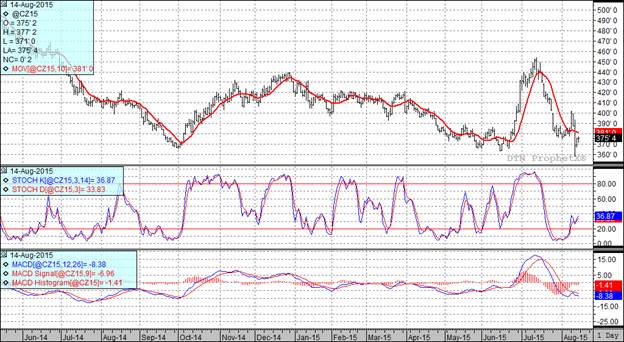

At the present time two of my three technical indicators are bearish both the September and December corn futures.

Soybean:

In addition to the weather stuff mentioned in the corn comments, the trade is still nervously looking at the Chinese situation as well as trying to sort out the numbers the USDA hit us with on Wednesday.

The Pro Farmer crop tour kicks off on Monday and it will be very interesting to see the projections coming out of that tour in light of the numbers the USDA gave us. It will be interesting to see if they confirm those kinds of numbers or cast doubt on the USDA’s methodology.

NOPA will release the soybean crush data won Monday. The average estimate for July is 141.475 million bushels versus 142.5 million in June. Records have been set in every month since February; the record for July is 142.6 million bushels.

The Chinese currency situation has traders on edge as well and I am sure we will see traders continue to watch what they do next with their currency; further actions could affect soybean sales and would probably be bearish.

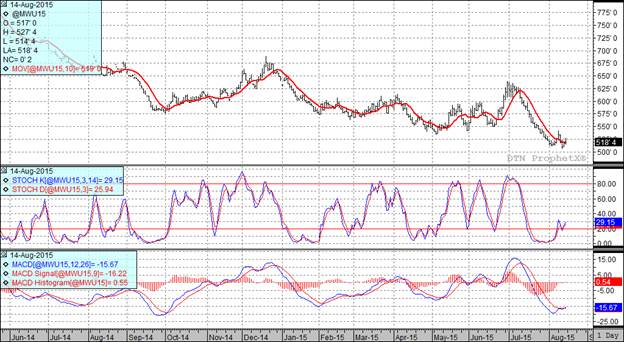

At the present time all three of my technical indicators are bearish both the September and November futures.

Wheat:

Harvest continues to progress nicely with the trade expecting spring wheat harvest to be around 48-55% complete by the end of the week.

While we are going to start wrapping up our neighbors to the north will soon be getting started. We should see Canadian wheat harvest begin in the next 10 days.

At the end of the day wheat still struggles to be competitive in the global markets. It appears to me that wheat is following corn as it tries to price itself into both the feed export markets.

With today’s close two of my three technical indicators are bullish the Minneapolis September futures while all three are now bullish the Kansas City September futures.

Top Trending Reads:

Topics: Grain Markets

%MCEPASTEBIN%