Closing Comments

Lynn Miller

January 19th, 2016

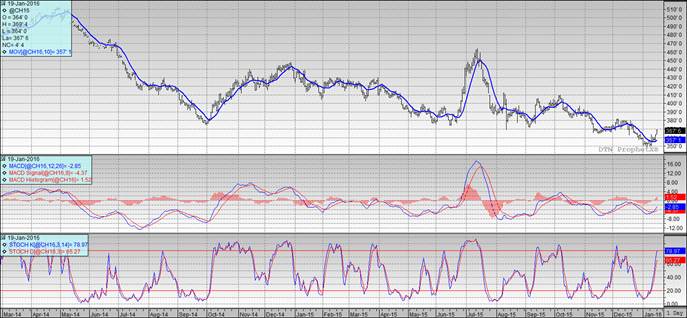

Corn:

Managed money covered shorts on lack of farmer selling today, that was the main push behind the gains. Informa’s estimates were out with 2016 corn acres at 88.9 million vs. 88.0 last year, with a total crop of 13.805 million bushels vs. 13.601 last year. These are not necessarily bullish numbers, but it is less than 90 million acres, so maybe we are ok.

Export sales also out today at 23 million bushels vs. 29 last year. Ethanol numbers will be out Thursday due to the holiday yesterday.

Technically, all three indicators continue to be bullish the March futures, although the stochastics are approaching over-bought territory. Even though we gapped higher today, nearby support still sits at $3.61. We did test the $3.69 level (50-day moving average) but were unable to get through it. Next sales targets would be $3.70, $3.82 followed by $3.95.

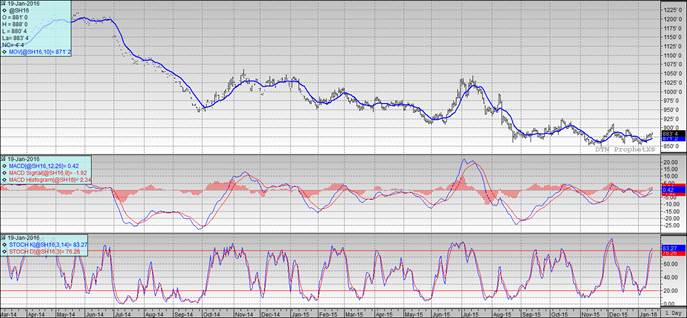

Soybeans:

Talk of steady Chinese demand and some logistical issues in South America lent support to the bean complex today. Weekly exports were at 51 million bushels vs. 45.7 million last week and 56 last year. Informa’s new acreage estimates were out today at 85.2 million vs. 84.5 last year, with total crop at 3,945 million vs. 3,930 last year. With the March 16 contract sitting at $8.81, we above the 20-, 50- and 100-day moving averages.

Technically overbought and lack of any new fundamental news tomorrow could spark a turnaround Tuesday tomorrow

Technically, all three indicators remain bullish the March. Our trading range remains narrow, but positive. The stochastics are now in overbought territory. Nearby support continues to hold at $8.75 after failing to close over $8.82. My selling targets are still $8.90, $9.00 then $9.12 if you really want to reach.

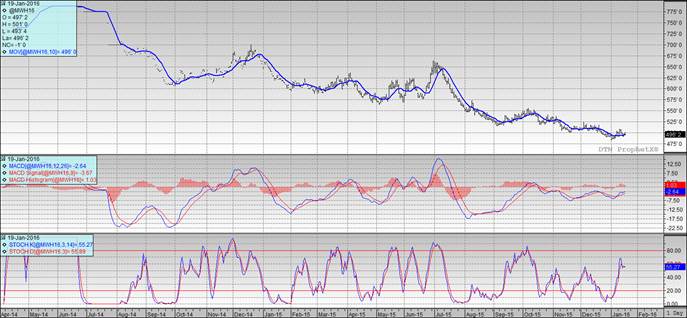

Wheat:

Higher world equity markets, led by China, helped energy and copper prices today which in turn helped Wheat. The US Dollar also slipped lower throughout the majority of the day. Weekly exports came in at 12 million bu same as last year. Informa’s new 2106 acres came in at 51.1 million for all wheats vs 54.6 last year. At face value this looks supportive; but, the US carryover is large enough to support us through next year with no problems. . The US is still the highest priced wheat in the world, which is why we have no interest from the domestic buyer of the world market.

Technically, two of three indicators are bullish the Minneapolis March futures. The MACD remains in buy mode and we did manage to close just over the moving average. However, the stochastics are confused and have signaled both to buy and to sell today. Nearby support has moved up to $4.93 and we hope can hold this as a low for a while. My price targets now would be $5.00, $5.10, $5.20, $5.28 and $5.39.

Top Trending Reads: