Closing Comments

Lynn Miller

January 20th, 2016

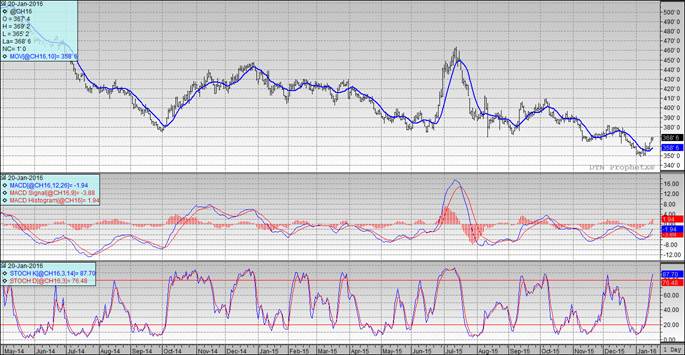

Corn:

A quiet choppy trade that managed to finish a penny higher with no desire to drive this market lower when none of the bear stories out there (albeit they are few) are coming to fruition. Funds managed to cover between 4 and 6,000 contracts of their short position, and I wonder how many of these were the reversal of long bean, short corn spreads?

The market will probably turn its attention to the ‘what if’s’ of the year to come, especially if yield assumptions leave the trade wanting to buy acres. We still haven’t seen anyone grab hold of the possibility that El Nino will leave a droughty La Nina in its wake. None the less, we need to find a way to generate US demand that isn’t ethanol to keep this carryout from growing.

Technically, all three indicators continue to be bullish the March futures, although the stochastics are approaching over-bought territory. Nearby support sits at $3.65. For the second day in a row we tested the $3.69 level (50-day moving average) but were unable to get through it. Next sales targets would be $3.70, $3.82 followed by $3.95.

Soybeans:

Bean business is slowly making it’s turn to South American origin. The PNW and the center gulf have both lost their advantage to Brazil in shipping to China, now within pennies. Talk of US Bean bookings being changed to optional origin has also started again. But the biggest hurdle of the day was the technical resistance we ran into against the moving averages. Funds added to their shorts approximately 4,000 contracts today. And again I wonder how many of these were the reversal of long bean/short corn spreads?

Technically, two of three indicators remain narrowly bullish the March with today’s action opening up our trading range to the downside I’m afraid. We managed to sneak in a close just barely over the moving average and the MACD remains bullish; however the stochastics have signaled to sell. Nearby support has set back to $8.53 when we failed to close over the $8.75 mark. My selling targets are $8.75, $8.85, $8.90, $9.00 then $9.12 if you really want to reach.

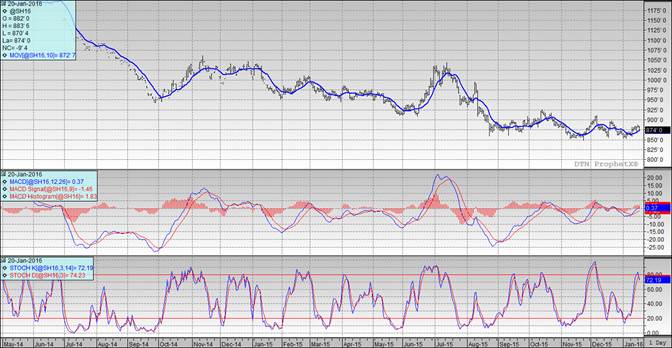

Wheat:

A weaker session today with European futures setting the tone. US offers continue to be higher than others around the world. We will likely be $30-$32/mt higher than Russia and France when Egypt tenders tonight. Russian winter wheat continues to benefit from additional snow cover. US Winter Wheat ratings continue to climb. Wheat is what’s its going to be: either we will fall lower struggling to be competitive, or we will find a weather issue to run us up.

On a good note, funds were not eager sellers and only added marginally to their short position today.

Technically, two of three indicators are now bearish the Minneapolis March futures. With only the MACD still in buy mode. We closed about $0.02 off the moving average and the stochastics appear to have signaled a sell. To my surprise nearby support held at $4.93 today. My price targets remain $5.00, $5.10, $5.20, $5.28 and $5.39.