Closing Comments

Lynn Miller

January 21st, 2016

A nice rally in US stocks and crude oil helped to lift the commodity market in general today.

Corn:

Some have thought that yesterday’s buying in corn was proof that this market has run out of sellers. We could be hopeful of that, but we continue to test the $3.69 level and fail to finish through it, finding a few sellers yet late session as producer movement stepped it up a little in the US.

The worst drought in three decades has damaged South Africa’s corn harvest, likely spurring increased imports in that country, while congestion at Brazilian ports may prompt some importers to shift grain to the US.

Ethanol numbers today were down from last week at 983,000 barrels/day and stock up yet again at 21.940 million barrels (up 7.6% from one year ago). Total grind was still 103.2 million bushels which is over the 98.4 million/week we need to reach the USDA’s estimate.

Export bookings have been delayed ‘til Friday with the holiday Monday. Expectations are 600-900,000t.

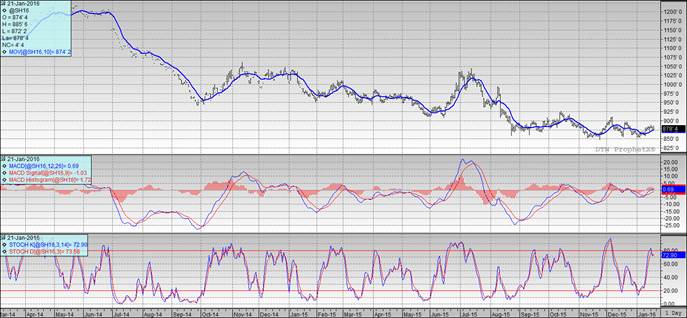

Technically, all three indicators continue to be bullish the March futures. Nearby support remains at $3.65. For the third day in a row we failed to close above the $3.69 level but we finally managed to trade through it. The 50-day moving average (green line) has now moved to $3.67 ½ and we closed just below that at $3.67. The stochastics are still positive, but have turned sharply as they enter overbought territory. Next sales targets would be $3.70, $3.82 followed by $3.95.

Soybeans:

A higher day for beans; however, still very much range bound as we try to find fundamentals to trade. Crush margins are improving. Many think the US farmer will turn bean acres into corn with low prices threatening profitability in either crop.

Farmers are reporting disappointing yields in Brazil’s state of Mato Grasso, which accounts for 30% of their soybean production and exports.

Export bookings tomorrow, expectations are 700, -1,000,000t

Technically, two of three indicators remain narrowly bullish the March futures. Once again we managed to sneak in a close just barely over the moving average and the MACD remains bullish. The stochastics remain in sell mode in neutral territory. Nearby support has stepped up to $8.75 with the close @ $8.78. My selling targets are $$8.85, $8.90, $9.00 then $9.12 if you really want to reach.

Wheat:

Wheat futures partially buoyed today on hopes of fresh world demand. Egypt announced an international tender yesterday saying it wanted to purchase Feb.20-Mar.1 shipment. The US remains uncompetitive; however, any sign of increased demand is a good sign and echoes through the market. Russia’s Dec grain exports hit a record 3.8 mmt, helped along by the record low ruble.

Export bookings tomorrow, expectations are 200-400,000t

Technically, all three indicators are once again bullish the Minneapolis March futures. Support continues to hold at $4.93 and the stochastics are once again in buy mode in neutral territory. My price targets remain $5.00, $5.10, $5.20, $5.28 and $5.39.