Closing Comments

Lynn Miller

January 22nd, 2016

Corn:

Export sales today were stellar at 1157.7 tmt WAY over the top end of the trade guess with the top three buyers being Mexico, Japan and Korea. Offers from Asia and Argentina still undercut the US by $0.12 for Feb delivery but that has narrowed from $0.21 last week.

A good rebound in crude oil, up $2.66/barrel last I looked, helped us along today as well.

Slower export pace out of Brazil with some backlog and increased demand is helping. The talked about the El Nino and how it’s not leaving as early as anticipated.. But let’s not rain on our own parade today, we’ll talk about the yield scenarios next week…

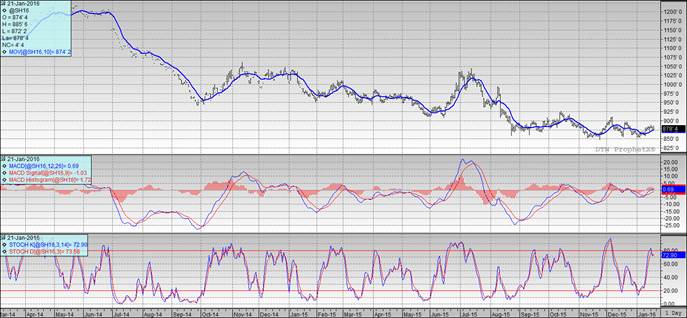

Technically, I think we had a good day today. The $3.69 mark has been like running into a concrete wall this week, to manage a close above it on good export numbers may give us momentum to carry this market the next leg up.

All three indicators continue to be bullish the March futures. Fourth day is the charm! Finally, a close over $3.69 and over the 50-day moving average. $3.69 is now our new support level. My next sales targets would be $3.82 followed by $3.95 and $4.10 if we can find momentum.

Soybeans:

Beans had a buy the rumor, sell the fact kind of day as they were expecting large sales to China. What we got was sales within expectations at 985.1 tmt. The US only has about a 2 week window here to get more sales booked to China before they go their Lunar New Year. US holds the clear advantage for shipments through mid-Feb before SA wins out.

From concerns of a drought in Brazil to now rains hampering their harvest it’s been a mixed bag. We did see increase South American selling today as we hang near key resistance levels.

Technically, two of three indicators remain narrowly bullish the March futures. For the second straight day we snuck in a close just barely over the moving average and the MACD remains bullish. The stochastics remain in sell mode in neutral territory, but not really going anywhere. Nearby support continues to hold at $8.75. My selling targets are $8.85, $8.90, $9.00 then $9.12 if you really want to reach.

Wheat:

Exports fell within expectations at 362 tmt with Japan being the biggest buyer. The market remains fairly quiet today. FSU weather isn’t threatening, rains in India are improving their drought conditions day by day and the US continues to miss out on export business. Other the same old, same old there really isn’t much new out there.

But I did find one tid bit today that is in our favor – the Ruble. Finally, it is gaining against the dollar. Today, it retraced 2 weeks of losses.

Technically, two of three indicators remain bullish the Minneapolis March futures. Support continues to hold at $4.93 the stochastics continue to be in buy mode as well as the MACD. We slipped below the moving average on the close today; however. My price targets have not changed and remain $5.00, $5.10, $5.20, $5.28 and $5.39.