Lynn Miller

January 25th, 2016

Food for thought: Is your condo full of beans and you want to haul corn? Here are a couple ideas. You can move delivered beans from Condo to free DP and free up space to pull your bin tops into the Condo space. Or, you could look at Basis Fixing your Condo beans to make more room. Basis fixes works good in a minimal carry or inverted market and will help you protect the current basis levels with forward levels wider. If you have any questions, give any of us in the grain department a call, we’ll run through the pros and cons with you.

Corn:

Corn had a hard fought battle today. Exports were dismal once again at only 24 million bushels vs 36 last year and the slow energy trade did nothing to give us support. The funds did some short covering to keeps us buoyed today.

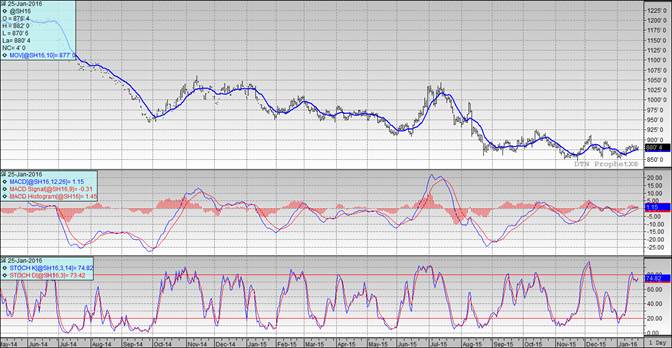

Technically, all three indicators continue to be bullish the March futures. Fourth day is the charm! Support continues to hold at $3.69 with a close just about that level. My next sales targets remain $3.82 followed by $3.95 and $4.10 if we can find momentum.

Soybeans:

Beans fought a mixed bag as well today with better Brazilian weather and lighter export sales to drag us down. Exports came in at 44 million bushels vs 57 last year. Then we have a higher domestic cash basis to add some support with the market feeling beans and meal are over sold to help us stay on the positive.

Technically, two of three indicators remain bullish the March futures. Nearby support continues to hold at $8.75, we did touch against the $8.82 resistance today and back off again. My selling targets are $8.82, $8.90, $9.00 then $9.12 if you really want to reach.

Wheat:

Managed money did some short covering today. That doesn’t take away the fact that world stocks are huge and the US is not competitive on the export market. Some talk that Russia will be limiting exports combined with Russian temps offered underlining support. Exports were 7 million bushels vs 12 last year.

Technically, all three indicators are once again bullish the Minneapolis March futures. Support has hopefully made a move upward to $4.98 with todays close. My price targets have not changed and remain $5.00, $5.10, $5.20, $5.28 and $5.39.