Closing Comments

Lynn Miller

January 26th, 2016

Corn:

A quiet, quiet session today with no new out there perceived as ‘market moving’. No exports today and ethanol numbers are out tomorrow. Lack of any upward movement kept producer at selling to a minimum (at least in the US). Most marketing targets are 15-20 cents over the current market.

Offers from Argentina out today were $0.25/bushel under US offers to the Far East. Export sales will be delayed at least one day due to the government office closures in DC.

Fund activity was relatively non-existent today.

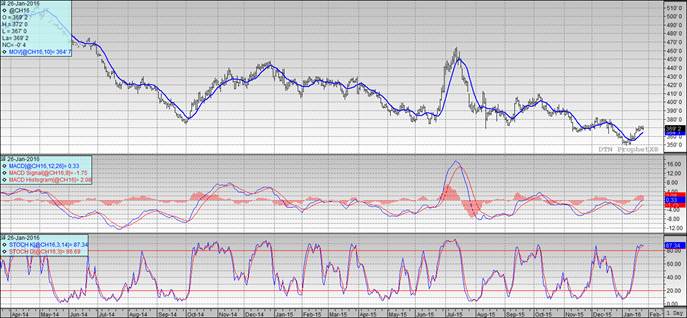

Technically, all three indicators continue to be bullish the March futures. Support appears to have held at $3.69 today; however, just barely. Question now will be did we open up a window to add some shorts? My next sales targets about $3.70 remain at $3.82 followed by $3.95 and $4.10 if we can find momentum.

Soybeans:

Values tumbled technically as the market had little to no momentum to carry through the moving averages. Offers into China are unchanged for the most part with the US dropping out of competition with South America beyond February. Looking forward, bean production needs to increase at a pace of 10mmt/year to keep up with demand growth.

The slowing of acreage expansion due to low profitability in South America could pull down carryout. It will be up to the market to decide if a 73 carryout will have as much weight as it did in 2013. The first question is will the Argentina farmer hoard as much of his crop now with the government intervention? If these beans don’t move, the draw down in available stocks could provide an elevator for prices to buy in acres.

Funds add 4,000 contracts to their already short position today.

Technically, two of three indicators have now turned bearish the March futures. We couldn’t hold over the moving average at the close today and the stochastics have issued a sell signal still in neutral territory. Nearby support continued to hold at $8.75. My selling targets are $8.82, $8.90, $9.00 then $9.12 if you really want to reach.

Wheat:

More technical short-covering today with the funds buying approximately 3,000 contracts lifting values throughout the session. Russia is in dire need of slowing down exports, their answer is adding an export tax – that is beneficial to the US. No emerging weather stories to trade at this time.

If you sitting on wheat – pay attention, the funds just might give us an opportunity here.

Technically, all three indicators remain bullish the Minneapolis March futures. Support has moved upward to $4.98 and held today. The close tonight, however, was right at the next resistance level of $5.03 to manage a close over this tomorrow we would once again move the support line. My price targets have not changed and remain $5.05, $5.10, $5.20, $5.28 and $5.39.