Closing Comments

Lynn Miller

October 20th, 2015

Just like outside markets set the tone yesterday, so did they today. Except today, they gave us a little shove in the right direction. The dollar kept a slightly negative tone for the entire session, crude battled for small gains and the DOW remained down a little. This was just enough to give commodities at least a glimmer of hope to start the day.

Corn:

We are all a little bit of Debbie Downer when we look at this corn market and the price environment we have lived through the past 2 years. But I want to bring to your attention how much better off we are then just 1 year ago. Last night’s close for December was $3.73 vs $3.48 one year ago. That’s $0.25 to our advantage. But then, you add in the basis picture, -0.98 under last year as we came into harvest with heavy freight costs, vs. the -0.68 we were last night. That’s another $0.30 to our advantage. So here we sit $0.55/bushel better than one year ago. If we have to have low prices, at least we have big bushels this year to compensate.

The story in corn is the same old same old today, a wicked fast harvest, good yield reports from the western corn belt and slow exports. What we really need now is a good old weather story for 2016 to give us a jump start.

Technically, two of three indicators remain bearish December corn as the stochastics have issued a buy signal. $3.80 is our next level of resistance as we try to move upward with $3.94 above that. My first selling target would be at $3.94, if you want to set your sites a little higher I would be looking at $4.06 and $4.17.

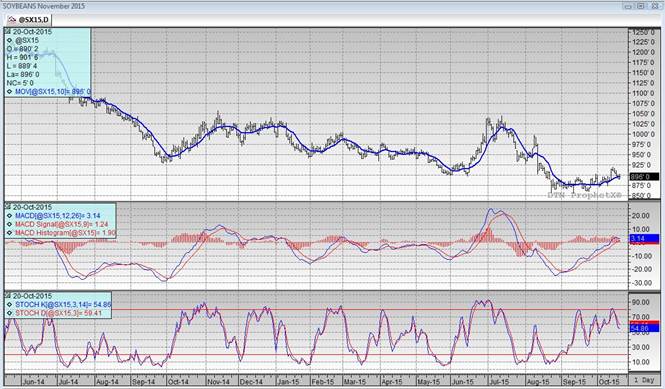

Soybeans:

Sales to China are becoming a nearly daily occurrence. Today, China bought 132,000 metric tons for 15/16. This is are the bushels finally coming to fruition from China’s visit last month. A couple other things that could play into this market are the Argentina Presidential election, which is this Sunday. Many feel this election could be crucial to the future of their agriculture. The opposition candidate is promising to eliminate export taxes. The Argentina currency is now battling like Brazil’s Reil as it continues to weaken versus the US Dollar.

Technically, two of three indicators are narrowly bullish the November futures as our close today was right back on the 10-day moving average. We haven’t seen enough to change the technical feel of this market. We are looking at $8.99 as our next resistance, which we did trade through that today but couldn’t manage to close above it. My selling targets would be $8.99, $9.27 and $9.50.

Wheat:

Still not much to talk about in wheat, we continue to battle large world supplies and poor export numbers, but there may be a glimmer of hope. It has come to my attention that we are working our way to competitiveness in this market – only $0.11 from being able to sell into Mexico! In Iraq’s hard wheat tender this week, Russia is the lowest offered at $254/ton. The US is narrowing the gap though now at $262.50.ton.

Technically, all three indicators remain bearish the December Minneapolis. We did see the stochastics tip upward in oversold territory, but it has yet to issue a buy signal. The market has a pretty good gap to make up to meet that 10-day moving average, that is the first hurdle to getting this turned around. $4.99 continues to be our main line of support; however, resistance levels have changed with the weaker close tonight. I would be willing to make sale at $5.17, $5.22 and $5.35.

Top Trending Reads: