Closing Comments

Lynn Miller

October 26th, 2015

Just announced today, a new Mina corn incentive program for shipments to the bunkers.

What you can expect:

- $0.05 premium to Mina’s posted bid

- Can haul existing contracts at a $0.05 premium

- DP program available with a $0.05 premium at time of pricing

- Mina discount schedules to apply

This is a temporary program eligible to the first 1 million bushels delivered.

All corn going into this program must be 16.5% moisture or less.

Please contact the grain department to make arraignments for delivery.

Corn:

We closed higher today, and near session highs. Buying linked to technical signals and an oversold fund portfolio. Exports today were 16 million bu vs. 29 million last year.

Harvest is expected to be near 75% complete tonight with very little farmer selling. Both elevators and producers alike are holding tight with the end user seeing very little corn, especially in the eastern belt.

Technically, all three indicators are now bullish December corn. We closed considerably above the 10-day moving average. The $3.80 yo-yo continues with this once again support. We’ll see if we can get any legs under this thing this time around. I’m continue to be a fan of $3.94 as a selling point I think we will get to. If you’re really bullish you could look at $4.06 and $4.17.

Soybeans:

Funds turned to sellers today on talk of higher US supplies, improved Brazil weather and the potential for China to slow their buying pace. Weekly exports were at 98 million bushels vs. 83 last year.

Harvest expected to be 85-90% tonight, for all practical purposes we’ll call it wrapped up. The farmer continues to be a strong flat priced holder here. The question is will basis and spreads take this market to a level the farmer will sell at? As the export program normalizes, we are going to need 40% of this crop in the pipeline by January. Current farmer selling is estimated between 15 & 20%. That’s a big gap for this pricing mechanism to make up

Technically, all three indicators are bearish the November futures. $8.54 is the new support line while my price objectives for the time being have not changed. I’m looking to sellat anything above the $9.00 futures mark. This is a good sale under the current market conditions and with nearby basis improvement. Additional selling points for me are $9.27, $9.50 and $9.72.

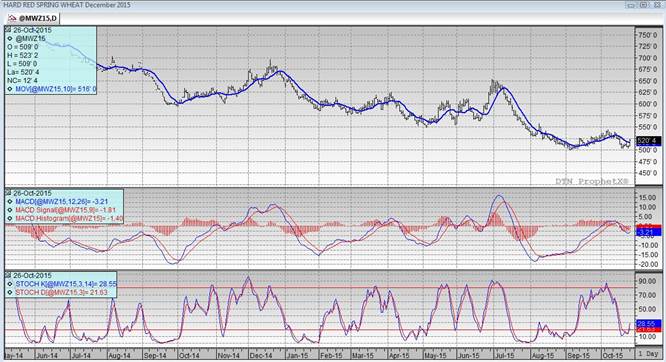

Wheat:

Funds and weather – that’s the story in wheat. Flooding rains in the seep south Winter Wheat country and a CFTC report showing the funds are shorter than expected both drove us up today. The funds were buyers of approximately 11,000 contracts. Weekly exports still on the low end of ranges at 12 million bushels; however, this is better than the 8 million this week last year.

We need to learn to take these rallies in this market when they are given to us. Record world supply and poor competitiveness in the export market are not going away anytime soon.

Technically, two of three indicators have turned bullish the December Minneapolis. Closing above the 10-day moving average and turning the stochastics to a buy signal. $4.99 continues to be our main line of support and resistance levels remain the same tonight with my selling targets at $5.22, $5.35 and $5.58.

Top Trending Reads: