Closing Comments

Lynn Miller

October 28th, 2015

Closing Comments

Lynn Miller

October 28th, 2015

Attention Craven Customers:

The railroad, otherwise known as BNSF, will be out to fix a switch tomorrow (Thursday, October 29th) near the Craven road. This work will close the road for the day. Trucks will still be able to get to Craven from the South. Sun Terminal will be able to accommodate all trucks that cannot make an alternate route into Craven.

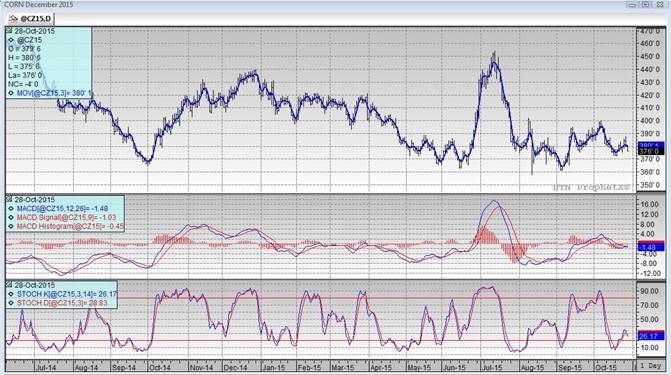

Corn:

A very defensive day in the corn market today as lack of demand news has pretty much suffocated any attempt a sustained rally. We have seen poor weekly sales, hear reports of Brazil corn working into the SE US and now rumor that China is putting a halt on US DDG’s.

Weekly ethanol was 944k barrels/day, down 7k barrels/day from last week, but up 0.75% from one year ago. Stocks fell by 600 thousand barrels to 18273.

Export sales tomorrow morning anticipated to be: 300,000-500,000 ton.

One point of interest to keep in the back of your mind as we wait for this market to quit focusing on supply and start to look forward to demand needs. That is China’s need to feed its livestock. China has been in the stone ages as far as feeding methods in both hogs and cattle, (albeit they are further advanced in the hogs). Just accepting modern practices could double their need for grain feeds. Now this won’t happen next year, but it will grow as they modernize and their demand for meat protein continues to grow.

Technically, all three indicators have committed to be bearish the December corn. Obviously the $3.80 mark did not hold again and is proving to be kind of fickle. If you run the number based solely on the most recent drop in prices, our hopes are dimmer. This puts selling targes at 3.83, 3.89 and $4.00. I will say it again, I continue to be a fan of $3.94 as a selling point. This is a resistance number off the whole down move from mid-July to early September. I think we will get to. If you’re really bullish you could look at $4.06 and $4.17. My opinion is $4.00 is going to be a tough mental battle to get through. Heck, we can’t even hold $3.80 consistantly.

Soybeans:

A week session in beans as well, driven mostly by improved weather forecasts in both Brazil and Argentina. The fall price for insurance is in the works (only 2 sessions to go). The running average right now is $8.92 compared to $9.73 this spring. Both prices are below the cost of production.

Indonesian had about the only positive market news today. They are saying that the forth coming El Nino will be worse than in 1997. That year they lost 7% of their palm oil production. That calculates out to 4.5mmt which equals 1 month’s worth of world oil usage. If this was to happen, bean oil would be the substitute so this is a weather story to keep an ear open to.

Bean sales tomorrow estimated at 1.6 – 2.0 mt.

Technically, all three indicators are bearish the January futures. I changed up a little as our bid moved to under the January tonight. Support now is$8.57 on the down side with selling points at $9.02, $9.31 and $9.54. I’m looking to sell at anything above the $9.00 futures mark, even with the move to January. This is a good sale under the current market conditions and with nearby basis improvement.

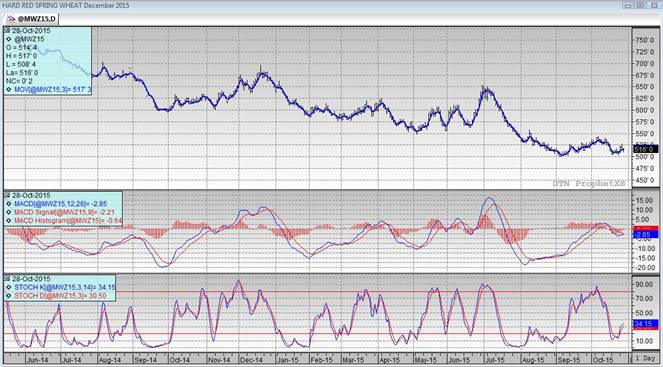

Wheat:

We rallied Monday due to a large net short position in the funds. We tried to hold that rally Tuesday on worse than expected Winter Wheat crop ratings. Wheat is just no fun, large wheat supplies and slow export demand just sit over our heads. It appears any hope in this market will be derived from the funds position. Take the rallies when you get them.

Export sales tomorrow anticipated between 350,000 – 550,000 tons. This will be yet another test of any changes in demand. World wheat prices are appreciating, but the US seems to continually remain about $20/ton more expensive.

Technically, two of three indicators remain marginally bearish the December Minneapolis futures. I was surprised with a down day, that we pretty much held our own technically when it could have really walked away. $4.99 continues to be our main line of support and resistance levels remain the same tonight with my selling targets at $5.22, $5.35 and $5.58 and on the high side $5.76.

Top Trending Reads: