Closing Comments

Lynn Miller

October 29th, 2015

Corn:

Finally, we had some better export number! Expectations were 300-500 tmt, but the actual number was 708.8. Sad to say, but no other real stories exist in the corn market. Exports still running 28% behind a year ago, still concern about China backing off on DDG imports and talk of Brazil corn coming into the US. Yes, all stories from yesterday, but when you have nothing else to trade these guys seem to just beat that poor dead horse.

Technically, two of three indicators are currently bearish the December corn. The stochastics have once again issued a buy signal. I’m with FC Stone, the stochastics are confused. Here’s that $3.80 mark again. Tonight we closed here, not so sure that is a reason to call this number support today, I’m still banking on $3.72 to hold. Yup, I’m a broken record, but I really do think sales need to be made on DP bushels when (hopefully) we get back to $3.94. If you’re really bullish you could look at $4.06 and $4.17.

Soybeans:

We had decent sales numbers in beans today to, coming in on the high end of expectations at 2.087 mmt. Despite that last couple of good sales weeks, we are still running 20% behind last year in commitments. With harvest winding down the focus will be on continued export demand, brazil weather and farmer selling.

Technically, all three indicators are bearish the January futures. Support continues at $8.57 on the down side with selling points at $9.02, $9.31 and $9.54. I’m still looking to sell at anything above the $9.00 futures mark. This is a good sale under the current market conditions, nearby basis improvement just adds a little extra to it.

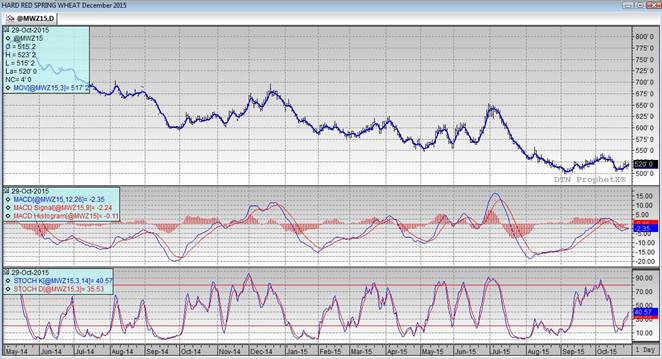

Wheat:

Good export numbers in Wheat today as well, coming in at 550.3 tmt. Total commitments are still lagging last year by 16%. Most of the action toady came from S. American production problems and technical buying into the close. Argentina’s wheat crop today was estimated at 9.5mmt in 15/16 vs. the USDA’s estimate of 10.5.

Technically, two of three indicators are now bullish the December Minneapolis futures. The stochastics are in buy mode and we closed just over the 10-day moving average today. One supportive feature is the MACD is coming together. Hopefully we can find some short-term momentum and get some orders filled. $4.99 continues to be our main line of support and resistance levels remain the same tonight with my selling targets at $5.35 and $5.58 and on the high side $5.76.

Top Trending Reads: