Closing Comments

Lynn Miller

October 30th, 2015

Daylight Savings Ends Saturday. “Let’s turn the clocks back so it can be dark at 4pm” said No One Ever.

Stay safe in the field and enjoy your “All Hallow’s Eve” tomorrow night.

Corn:

We were once again higher today in a really quiet session. Many link the slow climb in futures and improving basis levels to tight farmer holding. Although this plan may work for the time being, you need an exit plan. At some point this grain will move and it will move big which will take pressure off the futures and probably widen your basis as elevators try to make room. You should be thinking about price levels you are ready to sell at as opportunity may not last long when it comes. We saw this exact thing happen from June 29th – July 2nd this past summer and then it was gone again.

Technically, two of three indicators are once again bullish the December corn. The only indicator here that doesn’t seem to be confused is the MACD which is slowing coming together. So this fickle $3.80 support held today, but what about Monday? I’m probably going to say this every day, because I just really believe this is the first pricing opportunity we have had and probably missed twice now, but you really need to think about pricing DP bushels when (hopefully) we get back to $3.94. If you’re really bullish you could look at $4.06 and $4.17 after that.

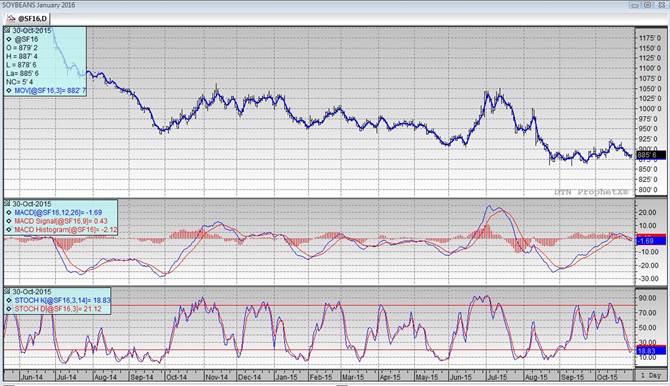

Soybeans:

Same story rings true in beans as lack of farmers selling keeps the top end open. Talk again today about increased export demand both beans and meal. If the Chinese pace should continue we could see Oct/Nov/Dec buying top out at 22 mmt – 3 mmt over last year.

Technically, all three indicators are bearish the January futures. The stochastics; however, have turned sharply upward in oversold territory. Support continues at $8.57 on the down side with selling points at $9.02, $9.31 and $9.54. I’m still looking to sell at anything above the $9.00 futures mark. This is a good sale under the current market conditions, nearby basis improvement just adds a little extra to it.

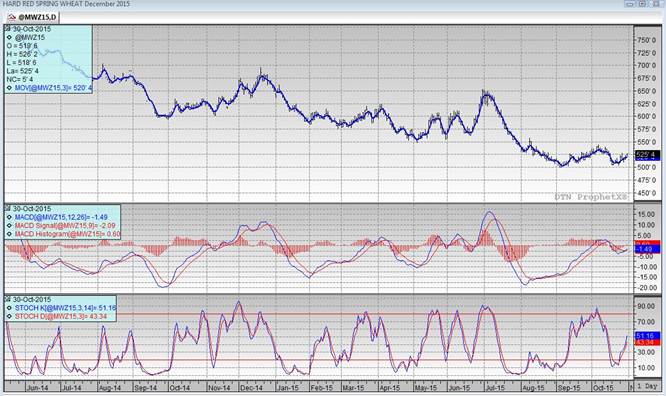

Wheat:

Problems in Australia’s crop boosting Wheat today, along with a weaker dollar to help us end near the 2 week high. Many link the week’s rally to funds short covering. We’ll take anything we can get to give a chance at some better prices, but in the end there is still a lot of cheaper wheat in the world than US wheat and that is one big hurdle.

Technically, two of three indicators are now bullish the December Minneapolis futures. The stochastics are still in buy mode and we once again closed over the 10-day moving average today. $4.99 continues to be our main line of support and resistance levels remain the same tonight with my selling targets at $5.35 and $5.58 and on the high side $5.76.

Top Trending Reads: