Closing Comments

Lynn Miller

November 30th, 2015

Free DP on Soybeans – effect immediately for all new deliveries.

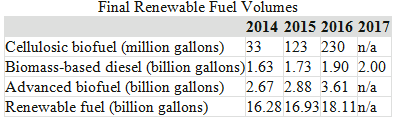

Corn:

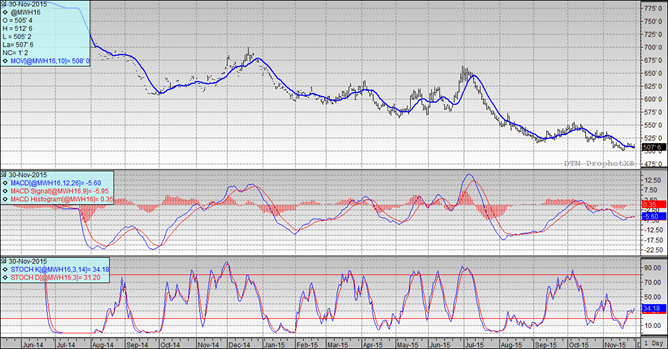

Prices trending higher in front of the anticipated release of the new ethanol mandate. Is was out about 2:00 after the market close: Implied Corn ethanol mandate for 2014, 13.61 bln gallons or 4861 mln bu usage. 2015 implied corn ethanol mandate is 14.05 bln gallons or 5017 mln bushels of usage. 2016 implied corn ethanol mandate is 14.5 bln gallons or 5180 mln bushels of usage.

The 2016 implied demand is way aggressive by the EPA, virtually taking the US out of the export market with forecasts of forcing domestic usage above the stubborn blend wall. RINs are probably going to spike as reality bumps into EPA expectations.

Weekly exports were 12 million bushels vs. 30 last year.

Technically, all three indicators are bullish the March. Nearby support continues to hold at $3.64. Now that the bid has changed to the March, my selling targets are $3.70, $3.77, $3.80 and $3.84.

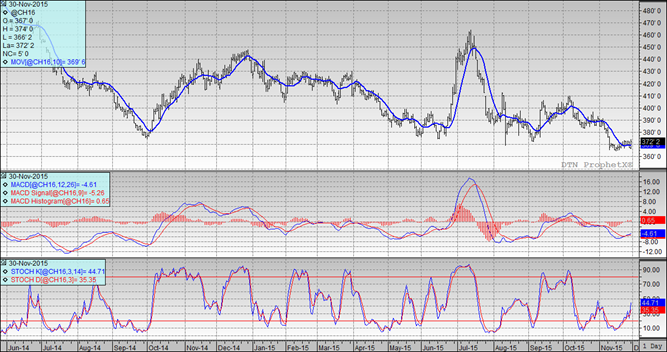

Soybeans:

Talk the new Argentine Ag Policy may not be as bearish as first thought added support today. Northern Brazil is starting to trend drier than normal, which helps US markets and then we have the funds that are shorter than anticipated.

Weekly exports were 67 million bushels vs. 75 last year.

Technically, all three indicators are bullish the March futures. The stochastics; however, are quickly approaching oversold. Nearby support $8.64 held throughout today’s session. Today’s price action changes my targets to $8.85, $8.94 and $9.05 on the high side.

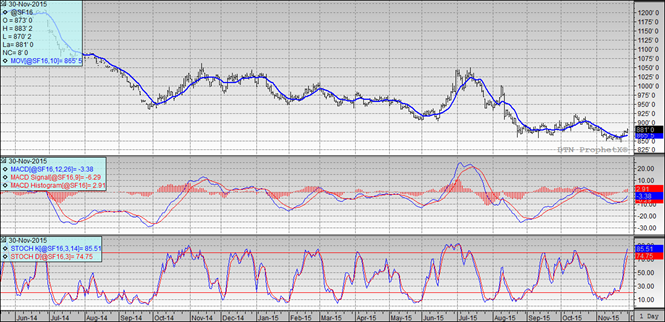

Wheat:

Minneapolis and Kansas markets rallied today on spread action. While better global weather, especially in the US and Russia added resistance. Some talk Russia will limit imports to Turkey.

Weekly exports 10 million bushels vs. 10 million last year.

Technically, all three indicators are bullish the March Minneapolis futures Nearby support holds at $5.00. My selling targets are now $5.13 $5.20, $5.27 and $5.34. If we can sustain a rally here we need to be ready to make some sales at $5.00 cash wheat.

Top Trending Reads: