Closing Comments

Lynn Miller

December 14th, 2015

Corn:

Short covering was the name of the game today. Spot barge freight a little weaker, CIF firm and well above DVE squeezing the shorts out of the market. The trade will now anticipate the CH taking over the expiring traits of the CZ (Which was $0.04 inverse to the March on expiration today). The next question will be when will all this corn move. The end user market is anticipating a large movement after January 1st, but will that happen at these levels? If not, we may see them come to the trough with improved basis levels once again.

Our next real market mover will come with the December 1st stocks report in January. Look for the trade to start anticipating this after the holidays. It seems we always get a 200-300 million bushel surprise with this report. I find it hard to believe that this would be in our favor this year with the fundamentals we have today.

Export inspections were as expected at 22.3 million bushels.

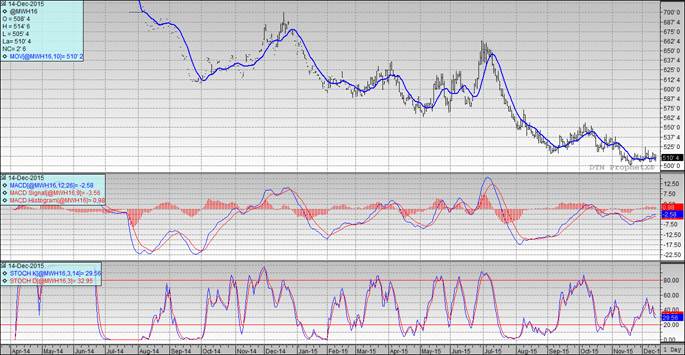

Technically, all three indicators remain bullish the March futures. Nearby support has moved up to $3.75. The stochastics have turned to buy mode; however, we are at the top-end of neutral territory. My selling targets remain at $3.80, $3.85 at the 50-day moving average level, followed by $3.94 and $4.10 should we be able to regain positive momentum.

Soybeans:

A rather lethargic trade today, with the March finding new contract lows for the move before coming back to trade near the 20-day moving average. President Marci did follow through on reducing soy export taxes 5%. One thought on today’s rally is that Argentina will be slow to drop their currency valuation, this would slow their farmer selling.

South American weather will become more important from here to harvest. Brazil’s northwestern growing regions are trending too dry, while southern Argentina is too wet.

Export inspections disappointing today at 49.4 million. NOPA crush numbers tomorrow expected at 161.7 million bushels.

Technically, all three indicators are once again bearish the March futures. Nearby support has backed off once again to $8.63. I would be looking to make catch up sales at $8.85, $8.94, $9.04 and $9.23. I would be looking for $9.30 (this would be the 200-day moving average) to put on a larger number of bushels.

Wheat:

Wheat futures were higher today for no apparent reason. No new news out there. Most believe we saw mostly short coverings today as the funds are anticipated short 67 thousand contracts. The dropping of Wheat export taxes in Argentina would increase imports there, if this happens we could see a need to cut US acres 6 million.

Export inspections today as expected at 16 million bushels.

Technically, two of three indicators are again bearish the March Minneapolis futures. We barely managed to hang onto a close at the 10-day moving average. The stochastics are in sell mode in neutral territory, but made a sharp move upward. The MACD is the only indicator still bullish as of the close today. Friday’s losses set the nearby support back to $5.00. I am still serious about pricing some wheat at $5.25 futures, this is the 50-day moving average and 33% retracement. If you need to make some catch-up sales I’d try to get bushels on at $5.21.

Top Trending Reads: