Closing Comments

Lynn Miller

December 17th, 2015

Corn:

Well, a sharp rally in the dollar along with the currency devaluation in Argentina brought us a new contract low this morning of $3.62 ¼. But we came off the lows nicely and it appears the selling has been exhausted for now. Argentina brokers are disappointed that they did not see any rampant selling on the devaluation this morning. Granted, the currency devaluation is bearish to them over time and there are a lot of logistics to work through before grains will be free flowing there.

Export sales, once again disappointing at 579.4 mmt.

Informa’s updated got buried today w/ the all the currency hoopla going on. They are suggesting an increase in production for this year of 46 million bushels. Increasing acres 80 thousand and yield by 0.7 bu/acre based on FSA data. This could be a foreshadowing to the December 1 stocks report coming up in January. On the other hand, they are projecting 2016 corn acres at 88.9 million, quite a bit below the USDA’s 90 million.

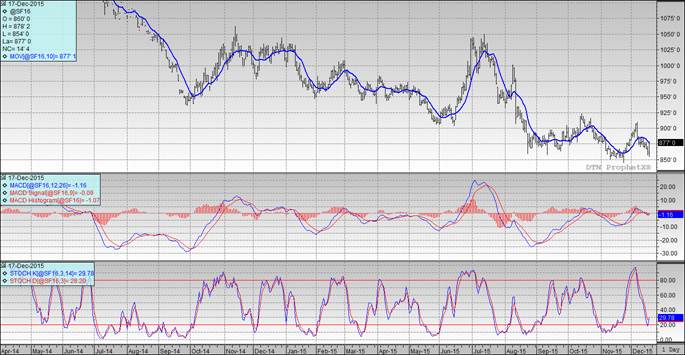

Technically, two of three indicators remain bearish the March futures. Nearby support continues to sit at $3.64; however it proved monumental for this level to hold today after trading through midession. The stochastics are still in sell mode, but tipped up dramatically this afternoon. My selling targets would be $3.75, $3.80 (which is now the 50-day moving average level) followed by $3.94.

Soybeans:

A nice key reversal on the bean charts today. Disappointing export sales at 887.8 mmt helped the dramatic reaction to the Argentine currency evaluation early on. A new sale of 424k sold to China was announced later this morning as we were touch some bargain picker prices on the low side of the day. The January/March spread went inverted today. So if you are holding January basis fixed contract, keep your eye out – we could very well get these rolled forward at no cost to you. Expiration is December 29th.

Informa’s numbers came in at 3.97 billion bu of production (11 million below the USDA) on 250,000 less acres. Acres for 2016 were guessed at 84.5 million.

Brazil weather is still on the radar. They desperately need to see a change in their dry pattern early next week as predicted. If this rain falls short, what type of risk premium could this market build in?

Argentina did not see a windfall of sales with the currency devaluation, opposite of what many expected. In the same respect, the price bounce this afternoon did not entice any US bean sales either.

Technically, two of three indicators are once again bullish the March futures. We managed to close right on the 10-day moving average to change this indicator to bullish. The stochastics tuned upward to issue a buy signal; however, the MACD is still lagging.. Nearby support remains at $8.63, which is a feat as we were trading lower early in the day session. My selling targets would still be $8.75, $8.84, $8.93 and $9.23 on the top side.

Wheat:

Export sales here were a pleasant surprise coming in around the middle of the trade guess at 320.2 mmt.

Informa’s number today for winter wheat were an 11 million bushel increase on FSA data that showed increased planting on 225k acres. Spring Wheat plantings were up 150,000 acres. All wheat acres for 2016 were estimated at 54.1 million. Up slightly from their last estimate, but down 1 million acres from last year.

For lack of any fresh news or weather scares, this market continue to tag along with corn and beans.

Technically, two of three indicators remain bearish the March Minneapolis futures. The stochastics, are on the verge of issuing a buy signal, while we still have a few cents to make up in the average department. Nearby support continues to hold at $5.00. I am still serious about pricing some wheat at $5.25 futures, this is the 50-day moving average and 33% retracement. If you need to make some catch-up sales I’d try to get bushels on at $5.13, $5.21. While above $5.25 my targets would be $5.28 and $5.34.

Top Trending Reads: