Closing Comments

Craig Haugaard

May 18, 2015

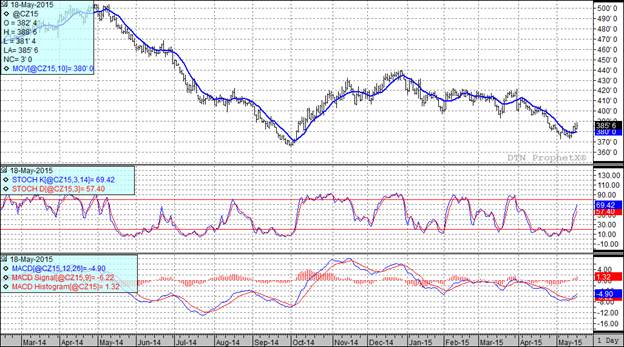

Corn:

All of the grain markets found support today with the forecast for cool, wet weather leading to speculators and funds buying back some of their short positions. While it can’t be denied that we face bearish fundamentals in both the USA and world markets the shorts in the market were heading for the sidelines today on the fear that the USA crop size could be reduced if the weather patterns we have been seeing continue into early summer. Of more immediate concern is the cold air that is going to hit the Dakotas and Minnesota tonight. Traders fear that emerging corn is vulnerable so with that in mind I would not be surprised to see additional upside in tomorrow’s session.

Speaking of emerging corn, we had the planting progress and crop condition reports out this afternoon. The corn crop is reported as 85% planted, up 10% from last week as well as being 10% ahead of the five year average. Emergence is also running ahead of normal with 56% of the crop emerged. Last week 29% was out of the ground and the five year average for this point in the year is emergence of 40%.

At the present time all three of my technical indicators are bullish both the July and December corn futures. According to our old buddy Fibonacci we should have solid resistance in the July futures at $3.75 and $3.87.

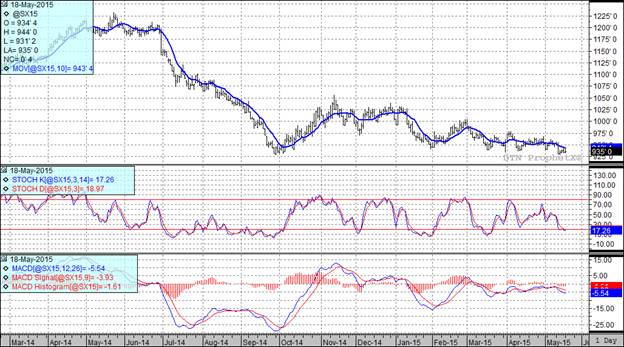

Soybean:

Beans struggled to close higher today and if we had not seen wheat and corn higher I am fairly confident that beans would have been lower for the session. The current weather is leading to some talk that we may not see all of the corn get planted and the conventional wisdom is that it will go to beans instead. That fear will act as a damper on prices as we move forward.

After the close we received the planting progress update. The trade was looking for 50% of the crop to be planted so the actual number of 45% may be slightly disappointing. It should be noted however that this is still well ahead of the five year average which is for 36% of the crop to be planted at this point. Today’s report also showed that 13% of the crop is emerged which is in line with the five year average of 12% emergence for this date.

At the present time all three of my technical indicators are bearish both the July and November soybean futures.

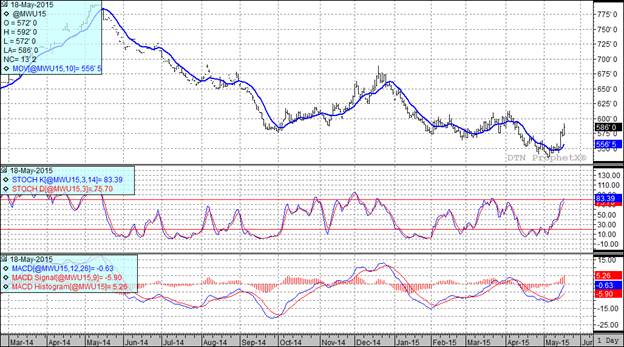

Wheat:

As mentioned in the corn comments, the freezing temperatures that hit the Canadian Prairies overnight are expected to whack the Dakotas and Minnesota tonight. The freeze could cause some harm to early emerging crops in both regions and may force some replanting. As hard as it is to imagine given our recent monsoon season we are seeing some drought concerns in Canada and that is supportive to prices as well.

Whatever the reason, wheat led the bullish parade once again today. Most of the movement was driven by short covering as we have recently seen the funds accumulate record short positions in both the Chicago and Kansas City markets. With the weather concerns traders seemed to feel it was time to take some money of the table.

This afternoon’s report has 68% of the winter wheat crop headed which is ahead of the five year average of 56% headed. The crop is currently rated as 45% good to excellent, up 1% from last week and well ahead of last year’s 29% good to excellent rating we had last year. Spring wheat was reported tonight as 94% planted. That is up from 87% last week and the five year average of 65% planted. In terms of emergence the crop is 67% emerged which is well ahead of the five year average of 38% emerged. The spring wheat crop is currently rated as 65% good to excellent.

All three of my technical indicators remain bullish both the Minneapolis and Kansas City July and September futures.

Top Trending Reads: