Closing Comments

Craig Haugaard

May 20, 2015

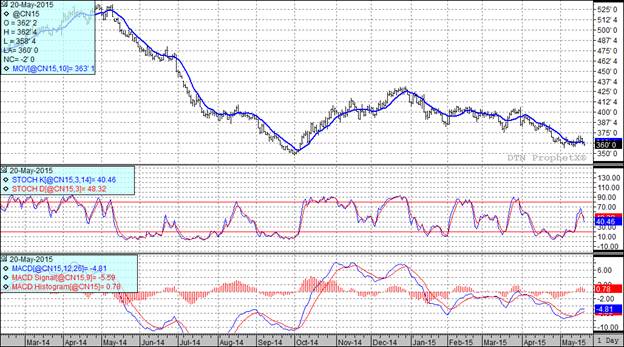

Corn:

We didn’t have a great deal of news today and as a result the market continued to drift lower. One report that was out today was the weekly ethanol report and that showed an excellent week last week with 100.59 million bushels of corn being ground last week to make ethanol. That is the biggest weekly grind since the week of February 13th. We now need to average 101.453 million bushels per week for the remainder of the marketing year to achieve the USDA projection.

This time of the year the weather is always a big story. At the present time we have excessive moisture in the southern plains and the general consensus is that areas of Kansas and Missouri could lose corn acres to beans and milo. While this would be positive it is offset by ample soil moisture which has the trade dreaming of large yields. In fact most traders are betting that when next week’s crop condition report comes out we will be shown a crop that is rated at or close to the highest rating ever for this date. That should keep pressure on the market.

At the present time two of my three technical indicators are bearish both the July and December corn futures. We saw funds adding to their short position during today’s session.

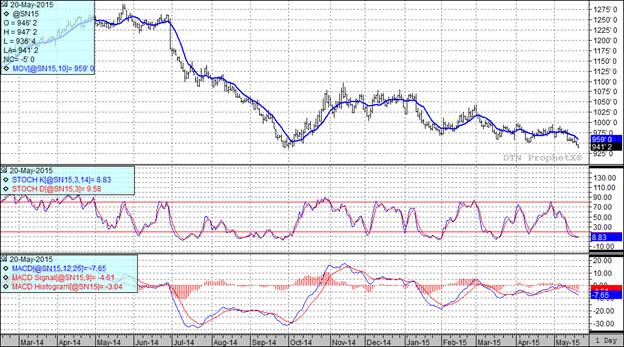

Soybean:

In the wonderful world of soybeans we continue to see a lack of farmer selling and basis levels that are firming up in some locations across the fruited plains. While this would normally be supportive to the market the overwhelming focus of the trade is the gihugic projected world and domestic carry-out. This is a damper that continues to pressure the bean market and may remain a depressing factor for an extended period of time. I think it will take a dramatic change of weather to generate a substantial rally.

At the present time all three of my technical indicators are bearish both the July and November soybean futures.

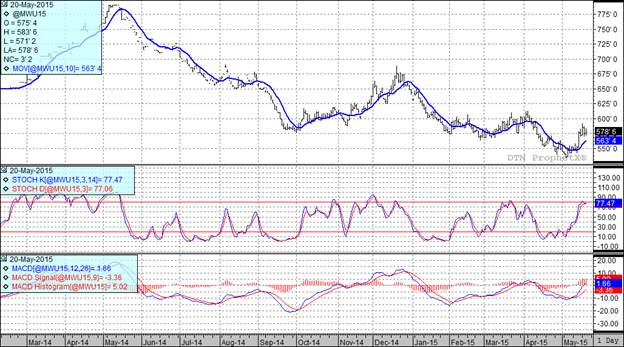

Wheat:

Weather is the key to the wheat market with some fears starting to pop up. One fear is that the extreme wetness in the southern plains will start to impact quality if it doesn’t dry out soon. Right now it looks like it will be dry for a day or two and then looks wet into next week. At some point that could become more bullish. We are also back to seeing some concerns raised over the potential damage that could be caused if the forecast cold temperatures for next week actually make an appearance.

On the bearish side of the ledger it is worth noting that USA wheat prices are a strong premium to world prices especially when compared to wheat coming out of the Black Sea region and the EU.

All three of my technical indicators remain bullish both the Minneapolis and Kansas City July and September futures although the stochastics are getting close to tipping over.

Top Trending Reads: