Closing Comments

Craig Haugaard

May 22, 2015

The markets will be closed Monday in honor of Memorial Day. As you are enjoying this long week-end I hope you will take some time to reflect on the sacrifices made by men and women in uniform to preserve this nation that Abraham Lincoln referred to as “the last best hope of earth.”

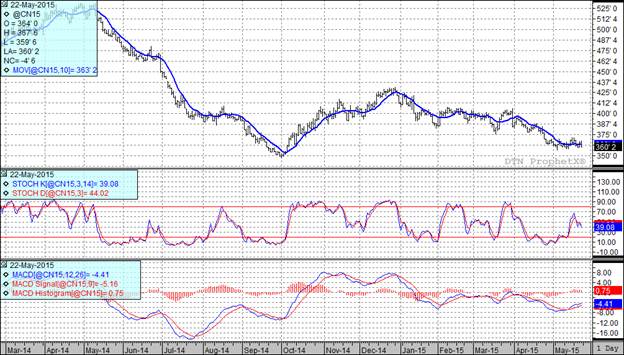

Corn:

The dollar was sharply higher today and that put pressure on the grain markets as we headed into the long week-end.

When the planting progress report comes out next week the trade is looking for a number in the 85 to 92% complete range. The five year average is for 88% of the crop to be planted by this time. We will also get our first crop conditions rating next week. The five year average is for 69% of the crop to be rated as good to excellent in this report. Last year we were at 76% good to excellent and some traders feel we may approach this number again in next week’s report. The best rating ever for this date was in 1986 when 81% of the crop was rated good to excellent at this stage.

It is interesting to hear reports of sprout damaged wheat coming out of Texas. The fear is that with the wet conditions in Texas and Oklahoma we could see more sprout damaged wheat showing up. With an abundance of corn the last thing we need is a bunch of sprout damaged feed wheat competing with corn.

At the present time two of my three technical indicators are bearish both the July and December corn futures as we continue to chop along in a sideways pattern.

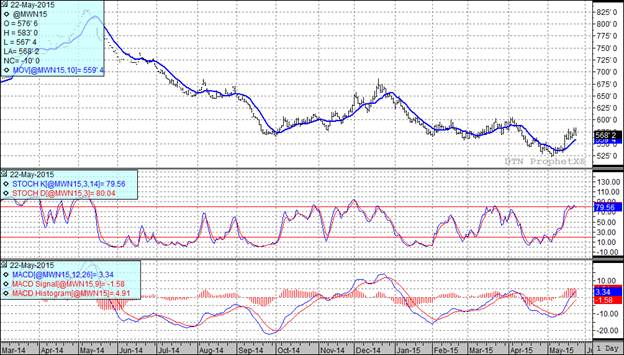

Soybean:

The strong dollar coupled with great weather combined to give this market the old pile driver today.

The bean market was also hurt by the ongoing bird flu situation. As things currently stand 40 million birds have or will be destroyed and that is expected to have an impact on soybean meal demand. Finally, as I mentioned earlier this week we are seeing negative crush margins in China and that is putting pressure on the bean market as well.

Heading into next week’s planting progress report the trade is expecting that planting will be 60 to 65% completed. The five year average is 55% completed for this date. There is ample evidence that suggests early planted bean crops tend to produce some pretty big yields. With that in mind I would expect this market to really struggle unless we get into a weather market. It is going to take a crop disaster some place to breathe some life back into this market.

At the present time all three of my technical indicators are bearish both the July and November soybean futures. If we have a big crop this fall I would not be surprised to see the new crop beans trade down into the $8.50 area.

Wheat:

There was very little news in the wheat market today and frankly what I did see was a little on the friendly side. In Texas and Oklahoma where they have been struggling with too much rain and the quality issues that come with that they have more rain forecast for this weekend with sizable amounts in in some localized areas so that mess continues. On the other hand Southern Russian wheat areas are hurting and in great need of a drink. With weather conditions remaining hot and dry into next week it doesn’t look like they have any relief on the way. At the end of the day I suspect what we experienced in the wheat pit today were traders that have made some nice profits on the long side of this market taking some money off the table ahead of the long week-end.

All three of my technical indicators remain bullish both the Minneapolis and Kansas City July and September futures although the stochastics are getting close to tipping over.

Top Trending Reads: